ProShares Ultra QQQ Sees Significant $253.5 Million Inflow

Recent week-over-week changes in shares outstanding among ETFs reveal that the ProShares Ultra QQQ (Symbol: QLD) has experienced notable activity. Specifically, there has been an approximate inflow of $253.5 million, representing a 3.8% increase in outstanding units, which rose from 70,150,000 to 72,850,000. Today, key constituents of QLD are also showing movement in the market: Apple Inc. (Symbol: AAPL) is down about 1.8%, NVIDIA Corp. (Symbol: NVDA) has dropped approximately 1.9%, and Microsoft Corporation (Symbol: MSFT) has decreased around 1.6%. For additional details, visit the QLD Holdings page.

Price Performance Comparison

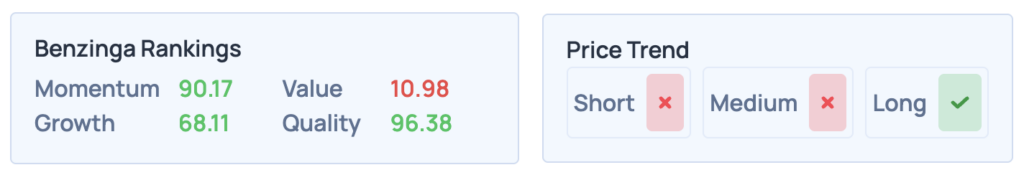

The chart below illustrates QLD’s one-year price performance in relation to its 200-day moving average:

In examining the chart, it is notable that QLD’s 52-week low stands at $75.28 per share, while the 52-week high is $120.6799, with the most recent trade recorded at $90.70. Evaluating the latest share price against the 200-day moving average can serve as a valuable technical analysis tactic. For more information on this analysis, visit this link.

Understanding ETF Transactions

Exchange-traded funds (ETFs) function similarly to stocks, but participants buy and sell “units” instead of “shares.” These units can be traded like stocks, but they can also be created or destroyed to respond to market demand. Each week, we monitor the week-over-week changes in shares outstanding to identify ETFs with significant inflows (many new units created) or outflows (many old units destroyed). The creation of new units necessitates purchasing the underlying holdings of the ETF, whereas the destruction of units requires selling these holdings. Consequently, significant inflows or outflows can also influence the individual components held within the ETFs.

![]() Click here to discover which 9 other ETFs have experienced notable inflows »

Click here to discover which 9 other ETFs have experienced notable inflows »

Also see:

- 10 Components Hedge Funds Are Selling

- OIA Market Cap History

- SMMF Historical Stock Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.