Dimensional US Marketwide Value ETF Sees Significant Inflows

Looking at the week-over-week changes in shares outstanding among ETFs, the Dimensional US Marketwide Value ETF (Symbol: DFUV) has emerged as a notable player. This ETF has reported an inflow of approximately $184.4 million, reflecting a 1.7% increase in outstanding units, rising from 272,700,000 to 277,400,000.

### Performance of Key Holdings

In today’s trading, some of the largest underlying components of DFUV are showing varied performance. Berkshire Hathaway Inc (Symbol: BRK.B) is down about 0.4%, Salesforce Inc (Symbol: CRM) remains flat, and The Cigna Group (Symbol: CI) is lower by approximately 0.2%. For an detailed view of the ETF’s holdings, refer to the DFUV Holdings page.

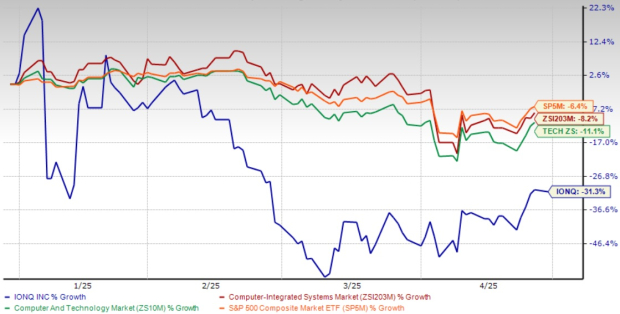

### One-Year Price Performance and Technical Analysis

The chart below illustrates DFUV’s price performance over the past year relative to its 200-day moving average:

DFUV’s 52-week price range has seen a low of $35.38 per share and a high of $44.6107, with the most recent trade occurring at $39.01. Comparing the latest share price to the 200-day moving average serves as a useful technical analysis method.

### Understanding Units in ETFs

Exchange-traded funds (ETFs) operate similarly to stocks, yet investors buy and sell “units” instead of “shares.” These units can be traded back and forth like stocks and can also be created or destroyed based on investor demand. Each week, we analyze changes in shares outstanding to identify ETFs experiencing significant inflows or outflows. The creation of new units requires purchasing the underlying holdings, while the destruction of units necessitates selling these holdings, impacting individual components within ETFs.

![]() Click here to discover which 9 other ETFs are witnessing notable inflows »

Click here to discover which 9 other ETFs are witnessing notable inflows »

Additional Resources:

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.