Significant Shareholder Withdrawals Impact Defiance Daily Target ETF

In recent analysis of week-over-week share trends among ETFs, the Defiance Daily Target 1.75X Long MSTR ETF (Symbol: MSTX) has made headlines. Notably, the ETF experienced an outflow of approximately $215.6 million, leading to an 11.0% decrease in shares outstanding—from 42,725,000 to 38,025,000.

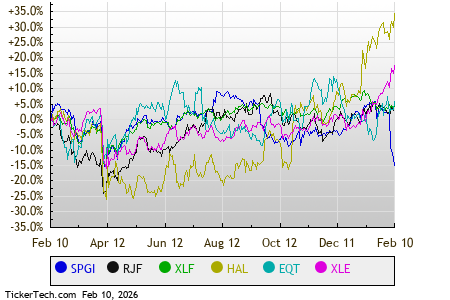

The following chart illustrates MSTX’s price performance over the past year compared to its 200-day moving average:

MSTX’s price fluctuated within a 52-week range, with a low of $15.18 per share and a high of $220.99. The latest closing price stands at $46.58. Analyzing these figures alongside the 200-day moving average can be a valuable technical analysis tool.

Exchange-traded funds (ETFs) share similarities with stock trading, with investors buying and selling “units” instead of “shares.” This flexibility allows the creation or destruction of units based on investor demand. Each week, we track changes in shares outstanding to highlight ETFs experiencing significant inflows or outflows. The creation of new units requires the purchase of the ETF’s underlying assets, while unit destruction involves selling them, which in turn affects the individual components held in these funds.

![]()

Click here to discover which other ETFs experienced notable outflows.

Also see:

- Stocks Conducting Buybacks That Hedge Funds Are Selling

- EVER Options Chain

- SELF Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.