XLG ETF Sees $379.5 Million Outflow Amid Market Shifts

In the latest analysis of ETFs from ETF Channel, significant changes were observed in the Invesco S&P 500 Top 50 ETF (Symbol: XLG). Recently, this ETF experienced an outflow of approximately $379.5 million, representing a 4.5% decrease in shares outstanding week over week, dropping from 183,890,000 to 175,590,000. Strong movements in major components were also noted, with Berkshire Hathaway Inc. (Symbol: BRK.B) increasing by about 1.2%, Eli Lilly (Symbol: LLY) rising by 0.8%, and Qualcomm Inc. (Symbol: QCOM) climbing 1.6%. For further details on all holdings, visit the XLG Holdings page.

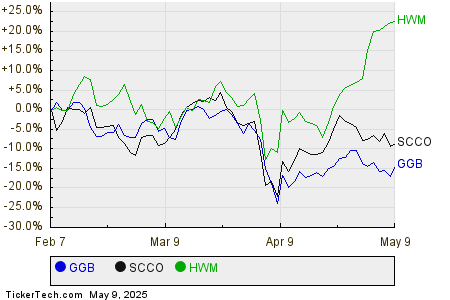

The following chart illustrates XLG’s one-year price performance against its 200-day moving average:

Examining the chart, XLG has recorded a 52-week low of $39.7499 per share and a 52-week high of $51.80. Currently, the last traded price stands at $46.22. Analyzing the share price in relation to the 200-day moving average can also be insightful for technical analysis—learn more about the 200-day moving average.

Exchange-traded funds (ETFs) function similarly to stocks, where investors buy and sell “units” instead of shares. These units are exchanged like stocks, yet they can also be created or destroyed based on investor demand. Weekly monitoring of the changes in shares outstanding helps identify ETFs with significant inflows (implying new units created) or outflows (indicating old units destroyed). The creation of new units leads to the purchase of the underlying ETF holdings, while unit destruction necessitates selling those holdings. Therefore, substantial flows can also influence the individual components within ETFs.

![]()

Click here to find out which nine other ETFs experienced notable outflows.

Also see:

- Hotels, Lodging, Restaurants, and Travel IPOs

- GOV Options Chain

- Funds Holding TFPN

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.