Direxion Daily S&P 500 Bull 3X ETF Experiences Significant Outflow

Looking at the week-over-week changes in shares outstanding among various ETFs, the Direxion Daily S&P 500 Bull 3X (Symbol: SPXL) stands out with an approximate $132.1 million outflow. This represents a 2.8% decrease in shares, dropping from 31,850,001 to 30,950,001.

Among SPXL’s major holdings, notable movements today include Netflix Inc (Symbol: NFLX), which is down about 2.4%, Philip Morris International Inc (Symbol: PM) up about 0.2%, and Accenture plc (Symbol: ACN), which has decreased by about 0.6%. For a complete list of holdings, visit the SPXL Holdings page »

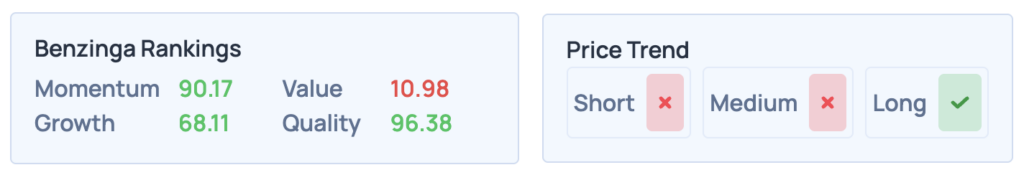

SPXL’s 52-week price range presents a low of $111.54 per share and a high of $190.34. Currently, its latest trading price stands at $141.03. Investors often compare this price to the 200-day moving average as part of their technical analysis strategy—more details can be found at the 200-day moving average ».

Exchange traded funds (ETFs) function like stocks, but when investors buy and sell, they are actually trading “units.” These units can be created or destroyed based on investor demand, allowing for flexibility in managing supply. Each week, we review the week-over-week changes in shares outstanding to identify ETFs with notable inflows (indicating new units created) or outflows (indicating old units destroyed). New unit creation necessitates the purchasing of the ETF’s underlying holdings, while unit destruction often leads to the selling of these holdings. Therefore, large flows can significantly impact the individual components held within ETFs.

![]() Click here to find out which 9 other ETFs experienced notable outflows »

Click here to find out which 9 other ETFs experienced notable outflows »

Also see:

- SCVL Split History

- Top Ten Hedge Funds Holding CSAN

- JBLU Market Cap History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.