ETFs Feel the Heat: Communication Services SPDR Fund Faces Significant Outflow

Week-Over-Week Change Highlights Financial Movement

Looking at the week-over-week changes in shares outstanding among ETFs, a notable shift is seen in The Communication Services Select Sector SPDR Fund (Symbol: XLC). This fund has experienced an outflow of approximately $121.2 million, representing a 0.7% decrease in shares outstanding from 206,150,000 to 204,800,000. Among XLC’s leading components, trading highlights include Netflix Inc (Symbol: NFLX) edging up by about 0.1%, Walt Disney Co. (Symbol: DIS) increasing by 1.5%, and AT&T Inc (Symbol: T) rising by 0.5%. A complete list of XLC’s holdings can be found on the XLC Holdings page.

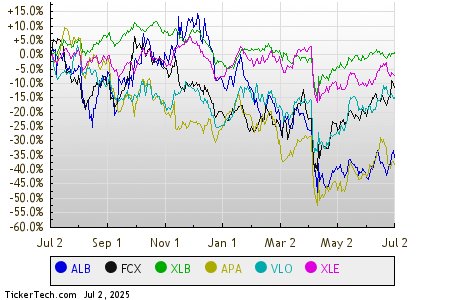

The chart below illustrates the one-year price performance of XLC against its 200-day moving average:

XLC’s share price has fluctuated within a 52-week range, dipping as low as $62.82 and peaking at $90.98. The most recent trade occurred at $90.59. Comparing this price to the 200-day moving average can provide insight into technical analysis—explore more about the 200-day moving average here.

Exchange-traded funds (ETFs) behave similarly to stocks, but investors buy and sell “units” instead of “shares.” These units can be created or destroyed based on investor demand, allowing for flexible trading. Each week, we monitor the changes in shares outstanding to identify ETFs with significant inflows (new units created) or outflows (existing units destroyed). The creation or destruction of units may require adjusting the underlying assets of the ETF, influencing the performance of its individual components.

![]() Click here to discover which 9 other ETFs have seen notable outflows »

Click here to discover which 9 other ETFs have seen notable outflows »

Also see:

- Highest Yielding BDCs

- SGLB Videos

- TBBK Average Annual Return

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.