Surge in Options Trading for Major Companies: AHCO, MATV, and TTWO See Notable Activity

AdaptHealth Corp (AHCO) Sees High Trading Volumes

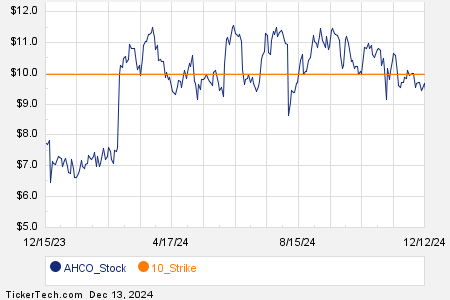

Looking at options trading activity among components of the Russell 3000 index, AdaptHealth Corp (Symbol: AHCO) stands out with significant activity today. A total of 9,233 contracts have been traded so far, which corresponds to roughly 923,300 underlying shares. This figure represents 110.3% of AHCO’s average daily trading volume over the past month, which is 837,080 shares. Notably, the $10 strike put option expiring June 20, 2025, recorded 5,697 contracts traded today, amounting to approximately 569,700 underlying shares.

Mativ Inc (MATV) Experiences Strong Options Trading

Mativ Inc (Symbol: MATV) also shows active options trading, with 4,001 contracts exchanged today. This volume equals about 400,100 underlying shares and makes up 93.5% of MATV’s average daily trading volume of 427,905 shares over the last month. The $12.50 strike call option expiring January 17, 2025, saw 1,999 contracts traded, which correlates to approximately 199,900 underlying shares.

Take-Two Interactive Software, Inc. (TTWO) on the Radar

Finally, Take-Two Interactive Software, Inc. (Symbol: TTWO) is witnessing robust trading with 10,413 contracts exchanged today. That equates to about 1.0 million underlying shares, representing 77.2% of TTWO’s average daily trading volume, which is 1.3 million shares. The $175 strike put option expiring January 24, 2025, garnered particular attention, seeing 3,063 contracts traded, which is about 306,300 underlying shares.

For various expirations available for AHCO, MATV, or TTWO options, you can visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

• FNDF Options Chain

• ROIV YTD Return

• CCRN Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.