Active Options Trading in Peabody Energy, Community Healthcare, and BlackRock

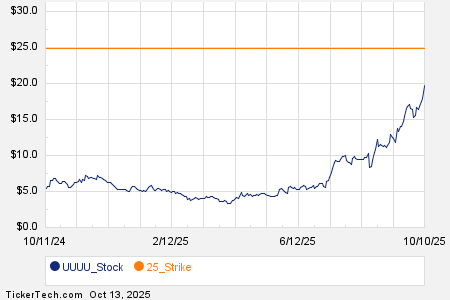

Today, options trading is significantly active among the components of the Russell 3000 index. Notably, Peabody Energy Corp (Symbol: BTU) has seen a total volume of 20,799 contracts traded so far, representing approximately 2.1 million underlying shares. This volume constitutes about 46.8% of BTU’s average daily trading volume of 4.4 million shares over the past month. The $5 strike put option expiring December 18, 2026, has drawn particular interest, with 10,662 contracts traded today, equating to roughly 1.1 million underlying shares of BTU. Below is a chart illustrating BTU’s trailing twelve-month trading history, highlighting the $5 strike in orange:

In addition, Community Healthcare Trust Inc (Symbol: CHCT) has recorded an options trading volume of 1,296 contracts today, which corresponds to approximately 129,600 underlying shares. This figure represents 46.1% of CHCT’s average daily trading volume over the past month of 280,890 shares. The $20 strike call option expiring March 21, 2025, has particularly high activity, with 1,115 contracts traded today, reflecting around 111,500 underlying shares of CHCT. Below is a chart showing CHCT’s trailing twelve-month trading history, with the $20 strike highlighted in orange:

Meanwhile, BlackRock Inc (Symbol: BLK) options show a trading volume of 3,906 contracts, representing about 390,600 underlying shares. This amount stands at roughly 45.9% of BLK’s average daily trading volume of 851,000 shares over the past month. Notably, the $910 strike put option expiring March 21, 2025, has seen strong interest with 219 contracts traded today, equivalent to approximately 21,900 underlying shares of BLK. Below is a chart illustrating BLK’s trailing twelve-month trading history, with the $910 strike marked in orange:

To explore the various available expirations for BTU, CHCT, or BLK options, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- Funds Holding FPX

- Institutional Holders of DUOT

- Institutional Holders of CIXX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.