Surge in Options Trading: fuboTV, United Rentals, and Citigroup in Focus

fuboTV (FUBO) Sees High Volume in Options Trading

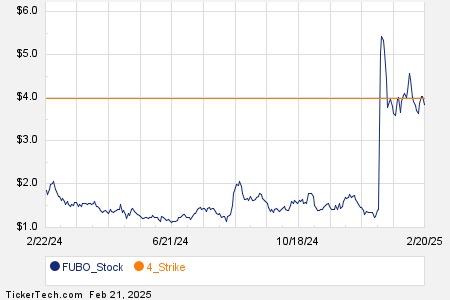

Looking at options trading within the Russell 3000 index, fuboTV Inc (Symbol: FUBO) is making waves today. A total of 110,467 contracts have been traded, which equates to about 11.0 million underlying shares—representing 51.5% of FUBO’s average daily trading volume over the last month of 21.4 million shares. Significant interest has emerged for the $4 strike call option expiring on February 21, 2025, with 17,710 contracts traded so far today, translating to roughly 1.8 million underlying shares of FUBO. Below is a chart displaying FUBO’s trading history, with the $4 strike highlighted in orange:

United Rentals (URI) Sees a Spike in Call Option Activity

United Rentals Inc (Symbol: URI) is also capturing investor attention, with an options trading volume of 3,017 contracts, representing around 301,700 underlying shares. This figure accounts for about 51% of URI’s average daily trading volume over the past month, which stands at 591,430 shares. The $750 strike call option expiring on March 21, 2025, has particularly high activity, with 165 contracts traded today, amounting to approximately 16,500 underlying shares of URI. Here is a chart showing URI’s trading history, with the $750 strike marked in orange:

Options Trading Volume Rises for Citigroup (C)

Citigroup Inc (Symbol: C) has recorded a substantial options trading volume of 68,751 contracts today. This represents around 6.9 million underlying shares, which is 50.9% of C’s average daily trading volume over the last month of 13.5 million shares. Particularly noteworthy is the activity surrounding the $95 strike call option expiring on January 16, 2026, with 4,021 contracts traded today, corresponding to approximately 402,100 underlying shares of C. Below is a chart illustrating C’s trading history, with the $95 strike indicated in orange:

To explore various options expirations for FUBO, URI, or C, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

Home Improvement Stores Dividend Stocks

Institutional Holders of DGNS

JELD Historical Earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.