Notable Options Trading Activity in Russell 3000 Index Components

Significant options trading volume has been observed today among key components of the Russell 3000 index. Marvell Technology Inc (Symbol: MRVL) led the way with a total of 156,398 contracts traded, equating to approximately 15.6 million underlying shares. This represents around 86.3% of MRVL’s average daily trading volume for the past month, which stands at 18.1 million shares. A notable spike occurred for the $40 strike put option set to expire on June 20, 2025, with 19,499 contracts traded, reflecting about 1.9 million underlying shares. Below, a chart illustrates MRVL’s trailing twelve-month trading history, highlighting the $40 strike in orange:

In another significant movement, Sunrun Inc (Symbol: RUN) reported options trading volume of 75,661 contracts, which corresponds to approximately 7.6 million underlying shares. This accounts for about 72.4% of RUN’s average daily trading volume, recorded at 10.5 million shares over the last month. A marked increase was seen for the $10 strike call option expiring on June 20, 2025, with 32,029 contracts traded, totaling around 3.2 million underlying shares. Below is a chart depicting RUN’s trailing twelve-month trading history, with the $10 strike option highlighted in orange:

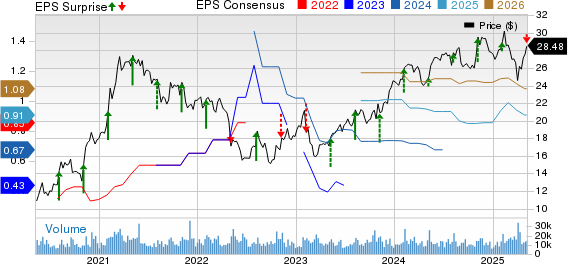

Ryder System, Inc. (Symbol: R) experienced options trading volume of 2,867 contracts, representing approximately 286,700 underlying shares. This constitutes roughly 69.7% of R’s average daily trading volume, which is 411,465 shares over the past month. Noteworthy activity occurred for the $135 strike put option set to expire on August 15, 2025, with 2,781 contracts traded, equivalent to about 278,100 underlying shares. A chart below shows R’s trailing twelve-month trading history, with the $135 strike indicated in orange:

For further details on various expiration options available for MRVL, RUN, or R, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.