High Options Trading Activity in Oracle, Goldman Sachs, and ServiceNow

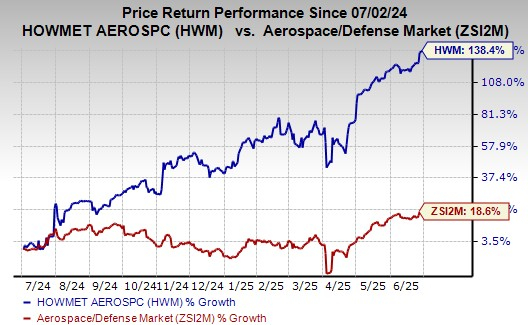

Today, options trading volume among S&P 500 companies saw significant activity, particularly with Oracle Corp (Symbol: ORCL). A total of 94,152 contracts have traded, which corresponds to approximately 9.4 million underlying shares. This volume represents about 102.7% of ORCL’s average daily trading volume over the past month, which is 9.2 million shares. The $170 strike call option expiring March 21, 2025, has attracted notable interest, with 3,521 contracts trading so far today—equivalent to around 352,100 underlying shares of ORCL. Below is a chart illustrating ORCL’s trailing twelve-month trading history, with the $170 strike highlighted in orange:

Goldman Sachs Group Inc (Symbol: GS) has also seen robust options trading, with a total volume of 24,036 contracts, representing roughly 2.4 million underlying shares. This figure accounts for approximately 83.5% of GS’s average daily trading volume over the past month, which is 2.9 million shares. High trading interest in the $450 strike put option expiring September 19, 2025, is evident, with 1,398 contracts exchanged today, translating to about 139,800 underlying shares of GS. Below is a chart showing GS’s trailing twelve-month trading history, with the $450 strike highlighted in orange:

ServiceNow Inc (Symbol: NOW) reported an options volume of 12,385 contracts on the same day, which equates to roughly 1.2 million underlying shares. This trading activity is 72.5% of NOW’s average daily volume for the past month—1.7 million shares. A notable amount of volume was recorded for the $750 strike put option expiring March 14, 2025, with 470 contracts traded, amounting to approximately 47,000 underlying shares of NOW. Below is a chart displaying NOW’s trailing twelve-month trading history, with the $750 strike highlighted in orange:

For various available expirations for ORCL, GS, or NOW options, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also See:

- CFB YTD Return

- ETFs Holding AMSC

- ETFs Holding FTD

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.