High Trading Volume for Dell, FedEx, and Lululemon Options

Analysis of Options Activity in Major S&P 500 Companies

Today’s options trading activity among companies in the S&P 500 index highlights significant interest in Dell Technologies Inc (Symbol: DELL). So far, a total of 39,232 contracts have been traded, equating to about 3.9 million underlying shares. Each contract represents 100 shares. This volume accounts for 58.2% of DELL’s average daily trading volume over the last month, which stands at 6.7 million shares. Notably, the $140 strike call option, expiring on November 22, 2024, saw high trading activity with 4,023 contracts exchanged. This represents around 402,300 underlying shares of DELL. Below is a chart depicting DELL’s trading history over the past twelve months, with the $140 strike highlighted in orange:

FedEx Corp (Symbol: FDX) witnessed a trading volume of 7,867 contracts today, which corresponds to roughly 786,700 underlying shares. This amount represents about 57.8% of FDX’s average daily trading volume over the past month of 1.4 million shares. The $300 strike call option expiring on November 22, 2024, also saw considerable trading, with 2,227 contracts traded today, equal to approximately 222,700 underlying shares of FDX. The following chart illustrates FDX’s trading history for the past twelve months, with the $300 strike highlighted in orange:

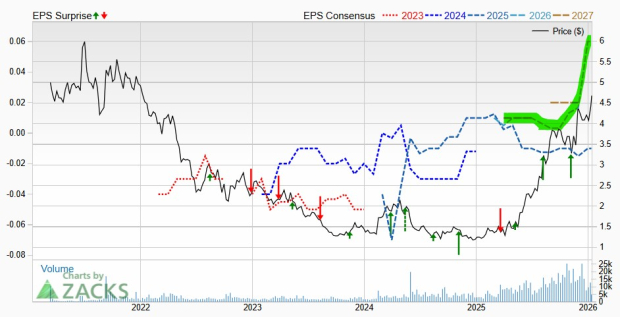

Lululemon Athletica Inc (Symbol: LULU) had a noteworthy options trading volume of 10,760 contracts, equivalent to about 1.1 million underlying shares. This figure also constitutes approximately 57.7% of LULU’s average daily trading volume of 1.9 million shares over the past month. The $350 strike call option, set to expire on November 22, 2024, registered 478 contracts traded today, representing roughly 47,800 underlying shares of LULU. A chart featuring LULU’s trading activity over the previous year, with the $350 strike highlighted, is shown below:

For various expiry dates available for options on DELL, FDX, or LULU, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- Top Ten Hedge Funds Holding MLPG

- Funds Holding KAR

- Institutional Holders of MAT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.