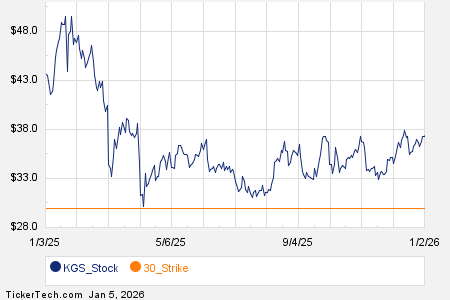

Among the components of the Russell 3000 index, Kodiak Gas Services Inc (KGS) recorded a notable options trading volume of 11,696 contracts on [date], representing approximately 1.2 million shares, which is 77.6% of its average daily trading volume of 1.5 million shares over the past month. The $30 strike put option expiring April 17, 2026, accounted for 6,000 contracts traded, equating to about 600,000 underlying shares.

Blackrock Inc (BLK) saw trading of 3,960 options contracts, indicating approximately 396,000 underlying shares, or 73.2% of its average daily trading volume of 540,740 shares. A significant amount of that volume came from the $1,220 strike call option expiring March 20, 2026, with 2,007 contracts traded, representing around 200,700 shares.

Additionally, QXO Inc (QXO) reported an impressive options trading volume of 47,224 contracts, equal to approximately 4.7 million underlying shares, or 71% of its average daily volume of 6.7 million shares. The $19 strike put option expiring May 15, 2026, saw trading of 5,300 contracts, which corresponds to about 530,000 underlying shares.