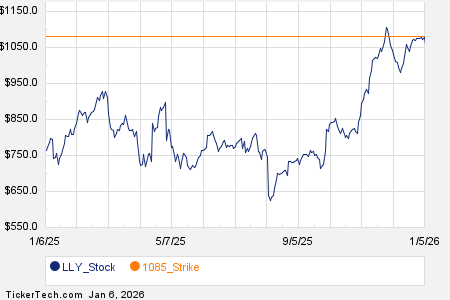

Among the Russell 3000 index components, Eli Lilly (LLY) experienced significant options trading today, with 34,119 contracts exchanged, equating to approximately 3.4 million underlying shares—116.1% of its average daily volume over the past month of 2.9 million shares. The $1085 strike call option expiring January 9, 2026, accounted for 4,582 contracts, representing around 458,200 underlying shares.

CrowdStrike Holdings Inc (CRWD) recorded options trading of 21,914 contracts, or about 2.2 million underlying shares, marking 103.2% of its average daily volume of 2.1 million shares. Notably, the $80 strike call option expiring January 16, 2026, had 1,606 contracts traded, equal to about 160,600 underlying shares.

Goldman Sachs Group Inc (GS) also saw robust options trading of 21,742 contracts, approximately 2.2 million underlying shares, or 100.2% of its average daily volume. The $950 strike call option expiring January 16, 2026, attracted 535 contracts, representing roughly 53,500 underlying shares.