SPDR Portfolio High Yield Bond ETF Sees $112.2 Million Outflow

In the latest update on week-over-week changes in shares outstanding for ETFs reported by ETF Channel, a notable trend has emerged with the SPDR Portfolio High Yield Bond ETF (Symbol: SPHY). The fund observed an approximate outflow of $112.2 million, reflecting a 1.5% decrease in shares outstanding, which dropped from 331 million to 326.2 million.

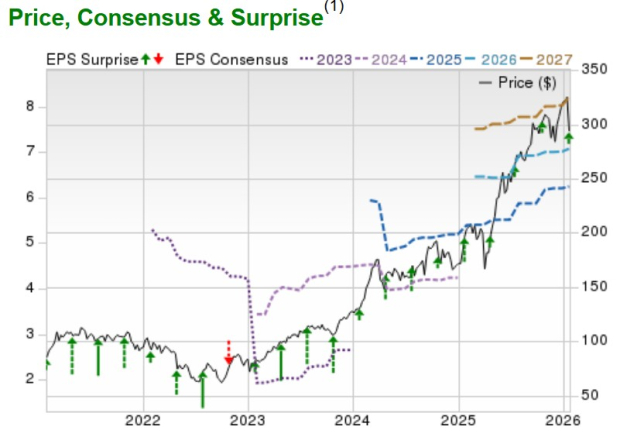

The accompanying chart illustrates the one-year price performance of SPHY in relation to its 200-day moving average:

In examining the chart, it is evident that SPHY’s lowest price point over the past year stands at $22.21 per share, while the highest price recorded is $24.07. The ETF was last traded at $23.23, and comparing this price to the 200-day moving average can serve as a useful tool for technical analysis.

Exchange-traded funds (ETFs) operate similarly to stocks; however, investors are technically trading “units” instead of traditional shares. These units can be traded like stocks and can also be created or destroyed based on demand. We monitor the weekly changes in shares outstanding to identify ETFs experiencing significant inflows, indicating new units created, or outflows, indicating units that have been removed. The creation of new units necessitates the purchase of the underlying assets of the ETF, while the destruction of units results in the sale of these assets. Thus, large flows can also influence the individual components held within the ETFs.

![]() Click here to discover which nine other ETFs have experienced notable outflows.

Click here to discover which nine other ETFs have experienced notable outflows.

Additional Insights:

- NUUU Insider Buying

- ETFs Holding XNCR

- VGAC Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.