Significant Options Trading Activity Among S&P 500 Companies

Today, notable options trading is observed in several S&P 500 index components, particularly PepsiCo Inc (Symbol: PEP). A total volume of 36,181 contracts has been traded, equating to approximately 3.6 million underlying shares since each contract represents 100 shares. This volume constitutes 43.2% of PEP’s average daily trading volume, which is 8.4 million shares over the past month. The $142 strike call option, expiring on April 25, 2025, attracted high interest, showing 2,063 contracts traded today, representing about 206,300 underlying shares of PEP. Below is the chart illustrating PEP’s trailing twelve-month trading history, with the $142 strike highlighted in orange:

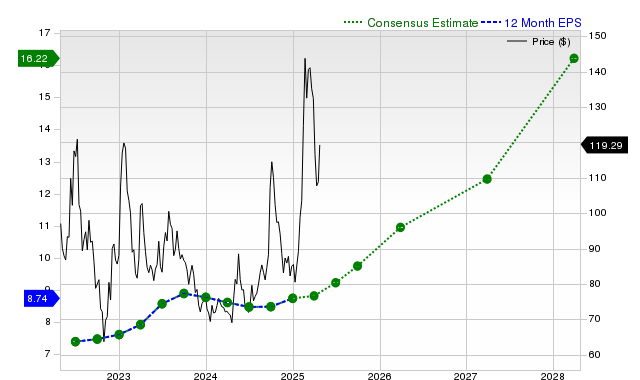

First Solar Inc (Symbol: FSLR) also reported significant options trading, with 16,566 contracts exchanged, translating to approximately 1.7 million underlying shares. This volume represents around 43.1% of FSLR’s average daily trading volume of 3.8 million shares over the last month. Notably, the $140 strike call option, expiring on April 25, 2025, exhibited high activity with 1,817 contracts traded, equating to about 181,700 underlying shares of FSLR. The chart below shows FSLR’s twelve-month trading history, highlighting the $140 strike in orange:

In another instance, Merck & Co Inc (Symbol: MRK) registered a substantial options trading volume of 67,913 contracts, approximately representing 6.8 million underlying shares. This is about 40.9% of MRK’s average daily trading volume, which is 16.6 million shares. The $75 strike put option, expiring on May 16, 2025, garnered significant interest, with 9,326 contracts traded today, equivalent to around 932,600 underlying shares of MRK. Below is the chart depicting MRK’s trailing twelve-month trading history, emphasizing the $75 strike in orange:

For a comprehensive look at the various expiration options available for PEP, FSLR, or MRK, please refer to StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

- Energy Stocks Hedge Funds Are Selling

- Funds Holding PSK

- ALEC Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.