Surge in Options Trading: Rocket Lab, Juniper Networks, and Bank of America Stand Out

Rocket Lab USA Inc Experiences High Options Volume

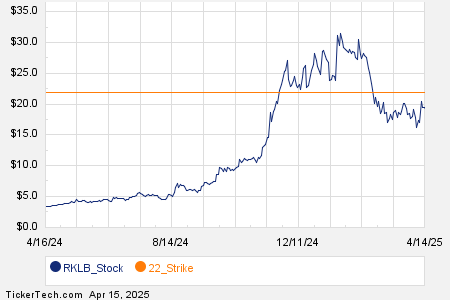

Among the Russell 3000 index components, Rocket Lab USA Inc (Symbol: RKLB) has shown significant options trading activity today. A total of 94,090 contracts have exchanged hands, which corresponds to approximately 9.4 million underlying shares. This volume represents about 57.5% of RKLB’s average daily trading volume over the past month, which stands at 16.4 million shares. Notably, the $22 strike call option expiring on April 17, 2025, accounted for a large portion of this activity, with 9,884 contracts traded, equivalent to roughly 988,400 underlying shares. Below is a chart detailing RKLB’s trailing twelve-month trading history, with the key $22 strike highlighted in orange:

Juniper Networks Inc Sees Strong Options Activity

Juniper Networks Inc (Symbol: JNPR) has also reported considerable options volume, with 15,798 contracts traded thus far. This indicates around 1.6 million underlying shares, constituting 57.1% of JNPR’s average daily trading volume over the last month, which is 2.8 million shares. A particularly notable portion of this activity is the $33 strike put option expiring on May 16, 2025, where 14,159 contracts have been traded, equating to approximately 1.4 million underlying shares. Below is a chart showcasing JNPR’s trailing twelve-month trading history, highlighting the $33 strike in orange:

Bank of America Corp Options Trading Volume Rises

Bank of America Corp (Symbol: BAC) is experiencing a surge in options volume, with 344,488 contracts traded today. This figure represents approximately 34.4 million underlying shares, making up 56.3% of BAC’s average daily trading volume over the past month, which is 61.2 million shares. The $39 strike call option expiring on April 17, 2025, is particularly active, with 28,628 contracts traded, translating to around 2.9 million underlying shares. Below is a chart illustrating BAC’s trailing twelve-month trading history, with the $39 strike highlighted in orange:

Explore Option Expiration Alternatives

For information regarding various expirations available for RKLB, JNPR, or BAC options, please visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

also see:

• ENTX YTD Return

• TSRA Insider Buying

• Institutional Holders of PDBA

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.