New Options for Schlumberger Ltd: Key Insights for Investors

Investors in Schlumberger Ltd (Symbol: SLB) can expect new options to begin trading today, specifically for the May 30th expiration. At Stock Options Channel, our YieldBoost formula has analyzed the SLB options chain for these new contracts and identified a noteworthy put and call contract.

The put contract at a $33.00 strike price currently has a bid of $1.45. An investor who sells-to-open this put contract will commit to buying the stock at $33.00 while collecting the premium, which effectively reduces the cost basis of the shares to $31.55, not including broker commissions. For those interested in acquiring shares of SLB, this approach offers an attractive alternative compared to the current market price of $33.24 per share.

Since the $33.00 strike price is approximately a 1% discount to the current trading price, there’s a chance that the put contract will expire worthless. Current analytical data, including greeks and implied greeks, suggest a 56% probability of this outcome. Stock Options Channel will monitor these odds over time and provide updates on our website through a detailed contract page. If the contract does expire worthless, the premium will yield a 4.39% return based on the cash commitment, translating to an annualized return of 32.08%, which we label as the YieldBoost.

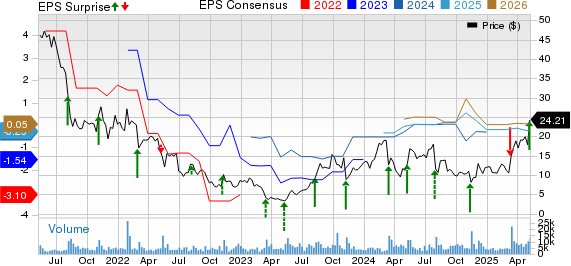

Below is a chart illustrating the trailing twelve-month trading history for Schlumberger Ltd, highlighting where the $33.00 strike is positioned within that context:

On the call side of the options market, the call contract at a $35.00 strike price has a current bid of $1.62. An investor purchasing SLB shares at the current rate of $33.24 and simultaneously selling-to-open this call contract as a “covered call” commits to selling the stock at $35.00. Including the premium, this strategy yields a potential total return of 10.17% if the stock is called away by the May 30th expiration date (excluding dividends and before commissions). However, significant upside potential may remain if SLB shares experience strong growth, making it essential to review the trailing twelve-month trading history and the company’s fundamentals. Below is a chart displaying SLB’s trading history, with the $35.00 strike highlighted in red:

The $35.00 strike translates to an approximate 5% premium over the current trading price. Thus, there is also a chance that the covered call contract might expire worthless, allowing the investor to retain both their shares and the premium. Current data indicate a 55% probability of that occurrence. On our website, Stock Options Channel will track these odds over time, providing historical charts for the option contract. Should the covered call contract expire worthless, the premium would represent a 4.87% additional return for the investor, or 35.58% annualized, also termed as the YieldBoost.

The implied volatility for the put contract is noted at 44%, while the call contract’s implied volatility sits at 53%. Meanwhile, the actual trailing twelve-month volatility, calculated from the last 251 trading days along with today’s price of $33.24, stands at 34%. For further options contract ideas, both put and call, consider visiting StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

also see:

- Top Dividend Stocks

- Top Ten Hedge Funds Holding DBP

- Top Ten Hedge Funds Holding ADK

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.