Analyst Targets Indicate Potential Upside for SLYG ETF Holdings

In our analysis at ETF Channel, we examined the underlying assets of various ETFs. This involved comparing the trading prices of each holding against the 12-month forward target price set by analysts. For the SPDR S&P 600 Small Cap Growth ETF (Symbol: SLYG), the weighted average implied analyst target price calculated for the ETF is $107.56 per unit.

Currently, SLYG is trading at approximately $83.92 per unit. This pricing suggests that analysts anticipate a 28.18% upside potential based on the average targets of its underlying holdings. Notably, three underlying assets with significant growth potential compared to their analyst target prices are Tandem Diabetes Care Inc (Symbol: TNDM), Helix Energy Solutions Group Inc (Symbol: HLX), and Shake Shack Inc (Symbol: SHAK).

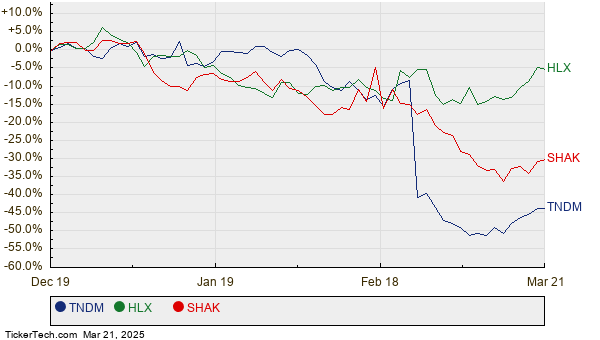

Tandem Diabetes Care Inc recently traded at $20.65 per share, but analysts predict a target price that is 105.43% higher at $42.42 per share. Helix Energy Solutions Group Inc shows a 65.89% upside potential from its latest share price of $8.64, with an average analyst target of $14.33 per share. Meanwhile, Shake Shack Inc has an expected target price of $134.28 per share, reflecting a 48.15% increase from its recent trading price of $90.64. The chart below illustrates the 12-month price performance of TNDM, HLX, and SHAK:

Here is a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 600 Small Cap Growth ETF | SLYG | $83.92 | $107.56 | 28.18% |

| Tandem Diabetes Care Inc | TNDM | $20.65 | $42.42 | 105.43% |

| Helix Energy Solutions Group Inc | HLX | $8.64 | $14.33 | 65.89% |

| Shake Shack Inc | SHAK | $90.64 | $134.28 | 48.15% |

These insights prompt essential questions: Are analysts justified in their target expectations, or are they overly optimistic about these companies’ future performance? Validating target prices against recent market developments is critical to determining their credibility. High price targets relative to a stock’s trading price can signal optimism but could also lead to potential downgrades if market conditions shift. These inquiries necessitate further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Institutional Holders of XMMO

• CREE market cap history

• AIRS Historical earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.