Reviving Beneath the Surface

Over the past five years, small-cap stocks and the Russell 2000 Index (IWM) have underperformed the other major U.S. equity indices. Amid the tempests of COVID-19 and choppy markets, the S&P 500 Index ETF (SPY) has soared 85%, while the Nasdaq 100 Index ETF (QQQ) surged 147%. Contrastingly, the Russell 2000 Index has languished in a prolonged downturn, mustering a modest 37% rise amid a challenging environment. A cautious Federal Reserve stance and exposure to the struggling commercial real estate sector have cast shadows on small caps.

After years of setbacks, investors are exploring new avenues for growth, flocking to tech stocks and avoiding sinking deeper into the small-cap quagmire. Despite its contrarian nature, five key metrics suggest that the small-cap realm may hold the keys to substantial profits in the upcoming year.

Seizing the Opportunity

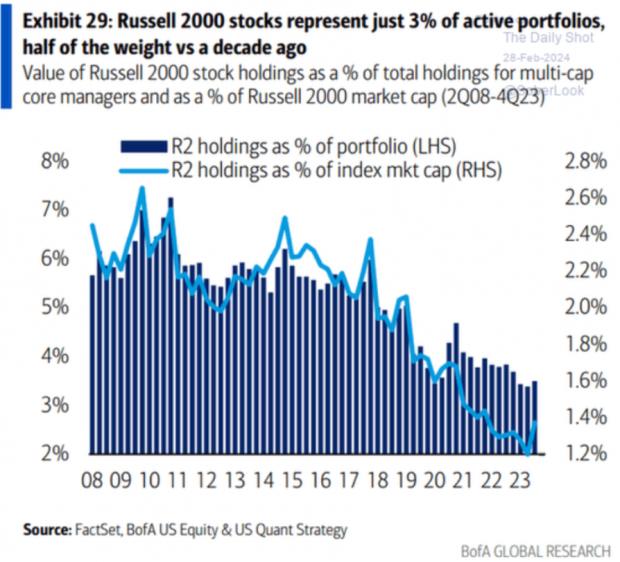

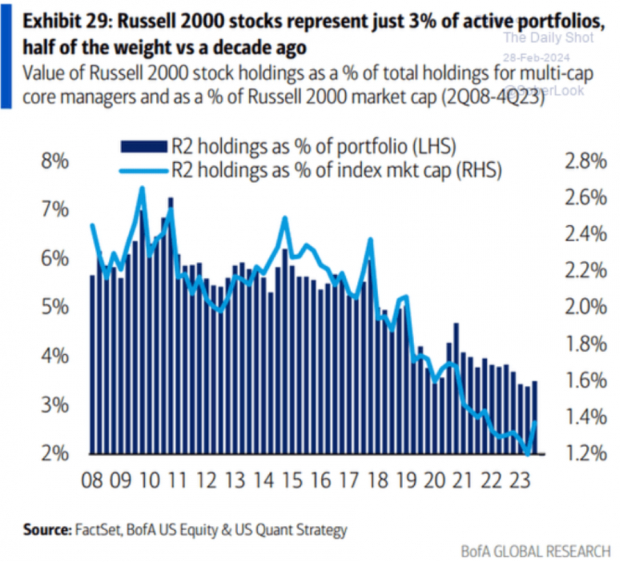

Smart investors thrive by taking the road less traveled. Recent data from Bank of America (BAC) reveals that small-cap stocks occupy a mere 3% of active portfolios, a stark drop from a decade ago.

Image Source: Bank of America

Following the Trail of Rate Cuts

In a recent update, Federal Reserve Chair Jerome Powell hinted at a dovish stance on interest rates, emphasizing that the central bank is yet to meet its 2% inflation target. Despite his assurances, many remain skeptical about rate cuts in 2024.

Rather than relying on guesswork or intuition, tracking monetary flows is my preferred strategy. The CME FedWatch Tool leverages federal funds futures contracts to project the likelihood of rate adjustments—a reflection of real market sentiment. Presently, the tool predicts five rate reductions by year-end (with over a 90% probability of at least three occurring). Lower interest rates bode well for small caps, trimming borrowing expenses, spurring economic vitality, and fostering enhanced profitability for nimble, growth-centric enterprises.

Finding Value in Growth

Russell 2000 stocks offer a value proposition compared to S&P 500 counterparts from a price-to-book lens, projected to outpace growth in 2024.

Image Source: Zacks Investment Research

Power of Resilience & Breakthrough Moments

In recent weeks, IWM has demonstrated resilience against QQQ. With stalwarts like Nvidia (NVDA) enjoying an eleven-week winning streak, now might be the opportune moment for a market sector rotation. Moreover, IWM is on the cusp of breaking out from a robust cup-with-handle base structure—an offshoot of a larger base formation tracing back two years! Adhering to the age-old Wall Street wisdom, “The longer the base, the higher in space.”

Image Source: TradingView

Resurgence in Regional Banks & CRE Stability

Time acts as a soothing balm. Following a rescue mission by a cohort of investors for regional powerhouse New York Community Bancorp (NYCB), the regional banking arena now exudes lesser risk. This observation holds significance for investors, given the substantial financial exposure within the small-cap domain. Furthermore, as the financial world distances itself from the pandemic-induced commercial real estate turmoil, its impact on small caps and the broader market diminishes.

Parting Thoughts

For investors seeking greener pastures, the small-cap arena presents a compelling case. Federal Reserve policies and prevailing sentiments are among the factors that could propel these stocks to greater heights in 2024.

Zacks Unveils ChatGPT “Sleeper” Stock

An obscure entity lies at the epicenter of the burgeoning Artificial Intelligence realm. By 2030, the AI industry is poised to unleash an economic juggernaut, rivaling the transformative impact of the internet and iPhone, amounting to $15.7 Trillion.

As a gesture of goodwill, Zacks offers a special report unpacking this explosive growth stock and four other “must-haves.” And more.

Download the ChatGPT Stock Report Now >>

Craving the latest insights from Zacks Investment Research? Delve into the 7 Best Stocks for the Next 30 Days today. Click here to secure this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

Access this article on Zacks.com here.

Zacks Investment Research

The observations shared are of the author and do not necessarily mirror the perspectives of Nasdaq, Inc.