“`html

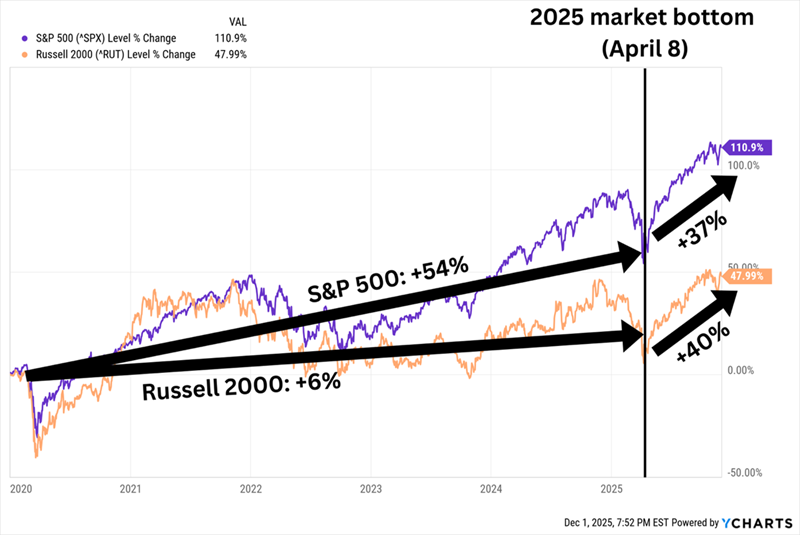

Recent market trends indicate a resurgence in small-cap stocks, which could indicate a bullish outlook as we approach 2026. Small-cap stocks are gaining attention following the Federal Reserve’s signals regarding potential rate cuts. These companies have been overshadowed by larger stocks over the past decade, but recent interest may change their fortunes.

Among the noteworthy small-cap firms is Nuveen Churchill Direct Lending (NCDL) with a dividend yield of 13.0%, and UWM Holdings (UWMC), yielding 7.1%. NCDL specializes in financing small businesses and benefits from a structure requiring high dividend payouts, while UWMC maintains a leading position in the American mortgage lending market, claiming an 8% market share. Other notable mentions include Redwood Trust (RWT) with a 12.7% yield, focusing on jumbo residential mortgages, and Franklin BSP Realty Trust (FBRT) yielding 13.3%, dealing primarily in commercial mortgage-backed securities.

As small-cap stocks regain market favor and capitalize on lower borrowing costs, their performance in terms of dividends could improve significantly, adding to their attractiveness for investors.

“`