Mastering Crypto Investment: Evaluating Performance Like a Pro

Investing in cryptocurrencies differs from investing in stocks and other financial instruments, but many principles overlap. While you can measure a crypto’s performance against the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), successful crypto investors often take a unique approach to evaluation.

Let’s delve into effective strategies for assessing your investments, providing valuable tools for your investment toolbox. You’ll find that this method is straightforward enough to adopt.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy. Learn More »

Comparing Performance to the Right Benchmarks

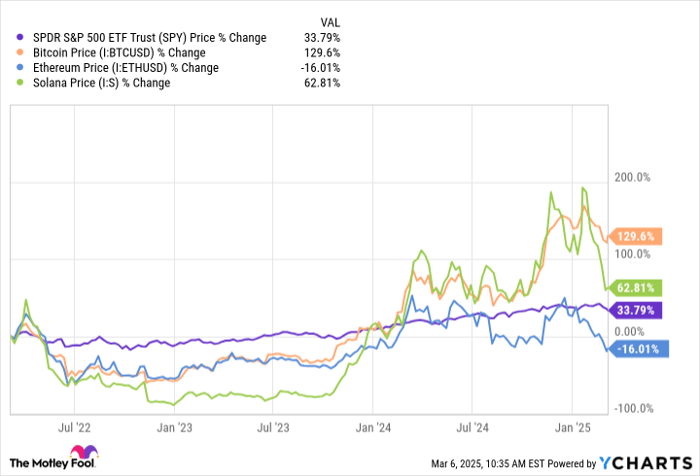

When investing, understanding whether your selected assets surpass simpler strategies, like an index fund reflecting the entire market, is crucial. If you’re focusing solely on Bitcoin (CRYPTO: BTC), that’s perfectly fine. However, once you expand to a diversified crypto portfolio with coins such as Ethereum (CRYPTO: ETH) and Solana (CRYPTO: SOL), benchmarking against the stock market might not be the most effective approach due to the differing asset performance.

Referencing the chart below, you can observe how these cryptocurrencies performed against the market over the past three years:

SPY data by YCharts.

What do you notice about the lines’ shapes? The cryptocurrencies show similar price actions that starkly contrast with the significantly less volatile stock market performance. This is due to the high correlation among cryptocurrencies, particularly with Bitcoin’s price movements.

These correlations arise from various factors. Mainly, once funds are on a blockchain, shifting them between blockchains often incurs less cost than converting back to fiat currency. As Bitcoin dominates the market, its price increases often lead to greater liquidity entering altcoins like Ethereum and Solana, boosting their prices.

While a loose relationship exists between the stock market and cryptocurrencies, focusing on Bitcoin when evaluating your investments offers greater clarity since it is the most default investment in the sector. It’s easy to overanalyze and choose riskier investments, only to find them underperforming relative to Bitcoin, just as selecting poor stocks can lead to market underperformance.

Evaluating Tokens Using Established Principles

Understanding how to assess tokens hosted on a blockchain is equally important. When purchasing a token, you can compare its performance against Bitcoin, providing a baseline for volatility. However, a more effective strategy is to measure a token’s performance against its native blockchain’s main coin.

For instance, if you invest in a decentralized finance (DeFi) token on Ethereum or Solana, consider whether its performance exceeds simply holding Ethereum or Solana, which would require less analytical effort.

Ultimately, this benchmarking approach simplifies your evaluation of crypto investments. While it’s not the only method available, overcomplicating your research may lead to biased conclusions instead of uncovering essential financial facts.

A Second Chance at a Potentially Lucrative Opportunity

Have you ever felt like you missed out on investing in successful stocks? Now may be your chance. Occasionally, our team of analysts issues a “Double Down” Stock recommendation for companies poised for significant growth.

If you’re concerned about missing out, now is an optimal time to invest before it’s too late. The returns tell a compelling story:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $292,207!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,326!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $480,568!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and these opportunities might not come again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Alex Carchidi has positions in Bitcoin, Ethereum, and Solana. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and Solana. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.