Snap-on Incorporated SNA continues its stride, propelled by steadfast market positioning and promising near-term prospects, supported by innovative products, a resilient franchise network, and sturdy financial performance. The company’s unwavering momentum and contributions from its Value Creation plan have been instrumental in its ongoing success.

Positive Momentum

Snap-on remains on course with its Rapid Continuous Improvement (“RCI”) process, along with other cost-reduction endeavors. The combination of increased sales volume, pricing actions, lower material and other costs, and gains from the RCI initiatives has facilitated margin expansion.

The company marked a year-over-year improvement in both top and bottom lines in the third quarter of 2023, with a 9% rise in earnings and a 5.2% uptick in sales.

Financial Performance and Market Positioning

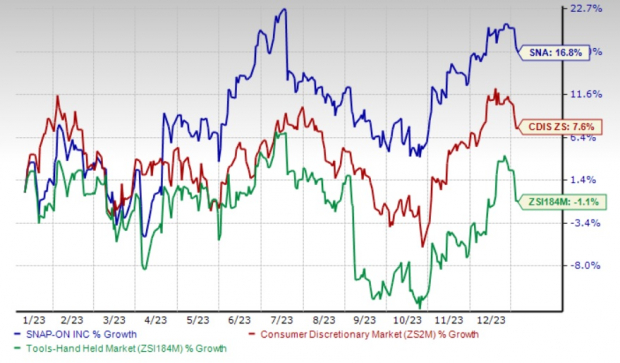

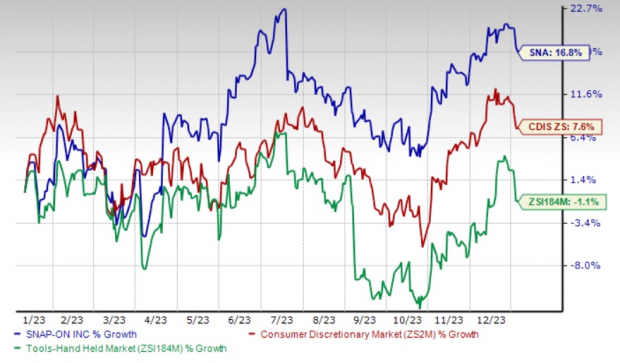

Snap-on, presently holding a Zacks Rank #2 (Buy), boasts a market capitalization of $14.8 billion. Over the past year, SNA’s shares have surged 16.8%, outpacing the industry’s 1.1% decline and the sector’s 7.6% rise in the same period.

The Zacks Consensus Estimate for SNA’s 2023 sales and earnings indicates a projected growth of 5.5% and 10.7%, respectively, from the previous year.

Image Source: Zacks Investment Research

Advantages for Snap-on

Snap-on’s resilient business model enables it to enhance value-creation processes, thereby elevating safety standards, service quality, customer satisfaction, and innovation. The company’s growth strategy zeroes in on three crucial areas: enriching the franchise network, fortifying relationships with repair shop owners and managers, and expanding critical industries in emerging markets.

The commitment to strategic principles and processes to create value, such as RCI, is a key focus for SNA. The RCI process is tailored to enrich organizational effectiveness and curtail costs, while also bolstering sales, margins, and generating savings. These savings reflect the benefits derived from continual productivity and process enhancement strategies.

Management is dedicated to amplifying customer services and refining manufacturing and supply chain capabilities through the RCI initiatives and additional investments. The company’s innovative capabilities stand as a strong asset, with ongoing investment in new products and amplifying brand awareness worldwide.

SNA’s business trends continue to exhibit strength, evident in its robust performance across operating segments. The Commercial & Industrial Group registered a 2.7% sales upturn from the previous year in the third quarter, driven by organic sales growth of 3.2%. Organic growth was bolstered by heightened activity with customers in critical industries.

The Tools Group segment experienced a 3.8% increase in sales year over year, attributed to organic sales growth of 3.7% and a favorable foreign currency impact of $0.5 million. Strong sales in international operations and U.S. franchise operations contributed to organic sales growth.

In the Repair Systems & Information Group, sales surged by 4.3% year over year, with organic sales growth of 3.1% and a positive currency impact of $4.8 million. Robust sales of diagnostics and repair information products to independent repair shop owners and managers, along with increased sales of under-car equipment, fueled organic sales growth. Furthermore, the Financial Services business witnessed an 8.7% year-over-year increase in revenues in the third quarter.

Other Notable Picks

Other top-ranked stocks from the broader Consumer Staples space include GIII Apparel Group GIII, lululemon athletica LULU, and The RealReal REAL.

GIII Apparel presently holds a Zacks Rank #1 (Strong Buy) and has maintained a four-quarter earnings surprise of 541.8%, on average.

lululemon currently has a Zacks Rank #2 and boasts a trailing four-quarter earnings surprise of 9.2%, on average.

RealReal also carries a Zacks Rank #2 and has seen a trailing four-quarter earnings surprise of 22.1%, on average.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Snap-On Incorporated (SNA) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

The RealReal, Inc. (REAL) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.