Snap’s Earnings Surge: A Bright Spot in Q3 2024 Financials

Snap (SNAP) announced its earnings for the third quarter of 2024, reporting 8 cents per share. This result not only surpassed the Zacks Consensus Estimate by 60% but also marked a staggering 300% increase compared to the same period last year. The announcement led to a stock price increase of over 10% in after-hours trading.

Revenue saw a significant boost, climbing 15.5% year over year to reach $1.37 billion, which also exceeded the Zacks Consensus Estimate by 1.36%.

Breaking down the revenue by region, North America contributed 62.5% of total revenue with an increase of 9.1% from last year, landing at $857.6 million. Europe provided 18.1% of revenues, up 24.3% year over year to $248.9 million. In the Rest of the World (ROW), revenues were $266.1 million, a notable increase of 31.6% compared to the previous year.

The average revenue per user (ARPU) also showed positive growth, rising 5.8% year over year to $3.10. In North America, Europe, and ROW, ARPU grew by 9.2%, 19.4%, and 13.5%, respectively.

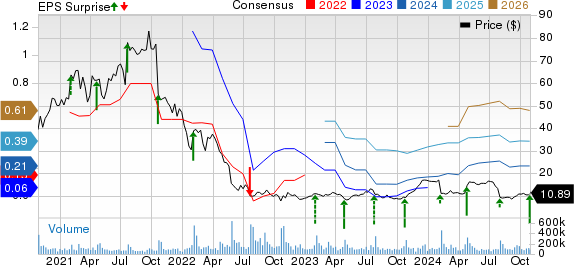

Stock Performance Metrics: Price, Consensus, and EPS Surprise

Snap Inc. price-consensus-eps-surprise-chart | Snap Inc. Quote

Boosted User Engagement Supports Third Quarter Revenue Growth

During the third quarter, Snap rolled out new AI features aimed at enhancing user interaction, creating engaging Snaps, and discovering new capabilities, including improvements to the AI within the Memories feature.

Additionally, new safety tools were introduced to assist educators and school administrators in understanding Snapchat usage among students. These efforts were part of Snap’s commitment to fostering safe spaces for its younger audience.

As a result of these innovations, Snap’s daily active user (DAU) count reached 443 million, reflecting a year-over-year increase of 9.1%. The platform added 11 million DAUs since the previous quarter. Notably, over 75% of users aged 13-34 in more than 25 countries engage with Snapchat on a regular basis. The total time users spent watching content on the platform rose by 25% year over year.

In terms of DAU breakdown, North America recorded 100 million, a slight decline of 1% from the previous year, while Europe increased by 4.2% to 99 million. The ROW segment saw a robust 15.6% year-over-year growth, bringing its total DAU to 244 million.

Moreover, Spotlight, Snap’s feature for sharing public Snaps, averaged over 500 million monthly active users in the quarter, marking a 21% rise from the previous year. The community shared over a billion Snaps publicly each month during this reported quarter.

In a strategic move, Snap expanded its partnership with Alphabet (GOOGL)-owned Google Cloud, focusing on enhancing generative AI experiences through its chatbot, My AI.

Snapchat+ subscriptions reached 12 million, effectively doubling compared to the previous year.

Ad Revenue Strategies Show Promise

On the advertising front, brand-oriented revenues dipped 1% year over year, reflecting a decrease in demand from certain consumer sectors.

Snap has faced competition from larger platforms, notably Facebook and Instagram’s parent company, Meta Platforms (META), as well as Pinterest (PINS). To bolster its position, Snap invested in machine learning and improved ad targeting, which helped more than double the number of active advertisers on Snapchat year over year in this quarter.

Current experiments with new ad formats, such as Sponsored Snaps and Promoted Places, aim to enhance engagement for businesses reaching Snapchat users. Furthermore, Snap launched First Lens Unlimited, positioning advertisers prominently within the Lens Carousel for maximum visibility. Also introduced was State-specific First Story, allowing U.S. advertisers to tailor campaigns for specific states.

Strong Growth in Augmented Reality Initiatives

Snap continues to innovate in the augmented reality (AR) space, unveiling the fifth generation of Spectacles, standalone AR glasses. These allow developers to utilize Lenses and interact with the environment, all powered by Snap OS.

Snap OS represents a new step in natural interaction technology, enabling control through hands and voice, eliminating the need for additional hardware.

Globally, over 375,000 AR creators contributed to building more than four million Lenses, indicating strong community engagement. This year alone, 150 million Spotlight videos featuring these Lenses were created.

During the Paris 2024 Games, over 225 million Snapchatters engaged with more than 25 custom Olympic-themed AR experiences.

To streamline AR content creation, Snap is launching new GenAI Suite features in Lens Studio. These updates include tools like Animation Blending and Body Morph, alongside a new Easy Lens tool allowing users to create Lenses quickly using just text prompts.

Financial Overview: Cost, Revenue, and Cash Flow

In the third quarter, adjusted cost of revenues rose 15.8% year over year, totaling $636.6 million.

Adjusted operating expenses reached $604.1 million, a slight increase of 0.9% from the previous year. Sales and marketing expenditures rose by 1.6% to $213.4 million, while general and administrative costs surged by 10.6% to $178.8 million. On the other hand, research and development expenses fell by 6.7%, totaling $211.8 million.

Adjusted EBITDA amounted to $132 million, a significant improvement from $40.1 million a year ago.

Cash Position and Future Outlook

As of September 30, 2024, Snap held $3.2 billion in cash and cash equivalents and marketable securities, an increase from $3.08 billion on June 30, 2024.

Operating cash flow stood at $115.87 million, a considerable increase from $12.78 million during the same period last year. Free cash flow improved to $71.83 million compared to a cash outflow of $60.65 million a year prior.

A new share repurchase program of $500 million has been authorized, reflecting confidence in financial stability.

Looking Ahead: Fourth Quarter Guidance

For the fourth quarter of 2024, Snap anticipates total revenues between $1.51 billion and $1.56 billion, projecting a year-over-year growth of 11-15%. Adjusted EBITDA is expected to range from $210 million to $260 million.

Management forecasts DAU to reach 451 million by the end of the fourth quarter.

Currently, SNAP holds a Zacks Rank #4 (Sell).

For a look at the top performing stocks, check out today’s list of Zacks #1 Rank (Strong Buy) stocks.

Zacks Identifies Top Semiconductor Stock

In a broader market context, Zacks highlights a semiconductor stock poised for significant growth, contrasting it with NVIDIA’s impressive performance, which has surged over 800% since its recommendation.

This new top pick is well-positioned to leverage the burgeoning demand for Artificial Intelligence, Machine Learning, and the Internet of Things, with global semiconductor manufacturing expected to grow from $452 billion in 2021 to $803 billion by 2028.

Discover More About This Stock >>

Interested in more insights from Zacks Investment Research? You can acquire the latest recommendations, including “5 Stocks Set to Double,” for free.

Get the Free Stock Analysis Reports on:

- Alphabet Inc. (GOOGL)

- Snap Inc. (SNAP)

- Pinterest, Inc. (PINS)

- Meta Platforms, Inc. (META)

You can access the original article on Zacks.com here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.