Synchronoss Technologies Posts Strong Monthly Gains Amid Cloud Growth

Synchronoss Technologies (SNCR) shares surged 28.2% in the past month, outperforming declines of 8.4% in the Zacks Computer & Technology sector and 12.4% in the Internet – Software industry.

The rise in SNCR’s stock can be attributed to impressive cloud subscriber growth, which resulted in a year-over-year revenue increase of 6.8% for the fourth quarter of 2024. Recently secured contract extensions and new product launches have boosted investor confidence, underscoring the company’s financial stability and strategic initiatives.

Key Contracts and Product Innovations Fuel Growth

Synchronoss has fortified its market standing by extending key contracts with AT&T and SFR. The three-year contract with AT&T, running through 2027, guarantees ongoing usage of Synchronoss’s personal cloud platform for secure content backup and sharing. Meanwhile, the SFR deal enhances SNCR’s footprint in Europe, responding to increasing demand for cloud services.

Further solidifying its market position, Synchronoss established long-term partnerships with Verizon (VZ) until 2030 and SoftBank until 2028. These agreements are pivotal for ensuring consistent revenue streams, expanding global reach, and supporting continuous innovation, laying the groundwork for long-term growth and opportunities.

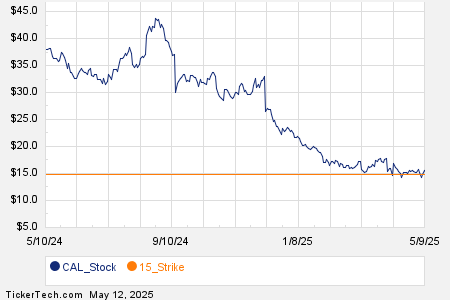

Synchronoss Technologies, Inc. Price and Consensus

Synchronoss Technologies, Inc. price-consensus-chart | Synchronoss Technologies, Inc. Quote

In March 2025, SNCR launched Capsyl Cloud, a comprehensive personal cloud solution for mobile operators and broadband providers. This platform enables quick deployment of secure cloud services, enhancing user engagement and revenue potential.

Innovative AI Integration Enhances Cloud Storage

SNCR is enhancing its personal cloud platform by incorporating artificial intelligence, aimed at improving user experience and driving business growth. A highlight of this advancement is the AI-driven “Genius” tool, which automatically optimizes photos through adjustments in lighting and color balance. It also includes creative features, allowing users to apply filters such as ocean and watercolor for quality edits.

Beyond convenience, AI integration strengthens security by proactively identifying and addressing potential threats, ensuring robust data protection. This evolution enhances Synchronoss’s platform capabilities and cements its leadership in cloud-based digital services.

Competitive Landscape in Personal Cloud Services

The personal cloud market is highly competitive, shaped by rapid technological change and evolving standards. Synchronoss faces significant challenges from major providers like Apple (AAPL), Google, Dropbox, Microsoft, and Amazon, all of which offer deeply integrated cloud services.

To compete effectively against these giants, SNCR offers a suite of solutions that connect subscribers with networks and content, greatly enhancing user experience. Its white-label cloud offerings empower telecommunications operators to deliver branded services, which help build stronger customer relationships and differentiate their offerings in a crowded marketplace.

Revenue and Earnings Outlook Presents Mixed Signals

The Zacks Consensus Estimate projects first-quarter 2025 revenues at $42.11 million, reflecting a 2% year-over-year decline. For the same period, earnings per share (EPS) are estimated at 29 cents, indicating a modest increase of one penny over the past month, yet signaling a 34.09% decrease from the previous year.

For 2025, projected revenues stand at $174.40 million, showing a year-over-year growth of 0.46%. Meanwhile, the consensus for EPS is set at $1.58, which represents an 8.2% rise in estimates over the last 30 days, despite a year-over-year decline of 3.07%.

Current Zacks Rank

Currently, SNCR holds a Zacks Rank #3 (Hold). For a comprehensive view of Zacks #1 Rank (Strong Buy) stocks, click here.

Access All Zacks Buys and Sells for Just $1

We’re serious about this offer.

Previously, we surprised members by granting 30-day access to our complete picks for only $1. There’s no obligation to spend anything more.

Many have seized this opportunity, while others hesitated, thinking there might be a catch. Our motivation? We aim for you to get to know our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others, which achieved 256 positions with double- and triple-digit gains in 2024 alone.

Would you like to see the latest recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days here.

For detailed analyses on stocks like AT&T Inc. (T), Apple Inc. (AAPL), Verizon Communications Inc. (VZ), and Synchronoss Technologies, Inc. (SNCR), feel free to request free stock analysis reports here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.