Synchronoss Technologies’ Remarkable Growth Outpaces Competitors

Synchronoss Technologies (SNCR) has experienced a significant 58.6% increase in its stock price over the past year. This growth notably surpasses the Zacks Internet – Software industry, which has seen a 32.1% return, and the broader Zacks Computer & Technology sector at 29.3%.

While competing in personal cloud services, SNCR has outshone industry giants like Microsoft (MSFT) and Dropbox (DBX). Microsoft’s stock rose 23.5%, whereas Dropbox’s fell by 3.9% during the same period.

The surge in SNCR’s performance is largely due to strong demand for its innovative personal cloud solutions and a robust partner network.

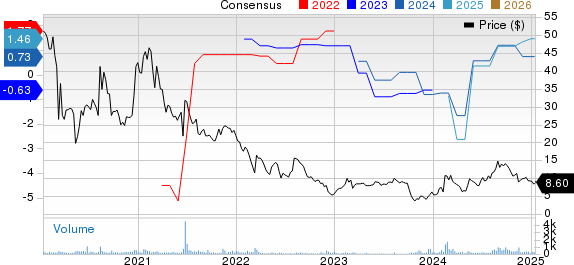

Analyzing Synchronoss Technologies, Inc. Price and Consensus

Synchronoss Technologies, Inc. price-consensus-chart | Synchronoss Technologies, Inc. Quote

SNCR Introduces Cutting-Edge Cloud Platform with AI Features

In the third quarter of 2024, SNCR reported a 5.1% increase in the number of cloud subscribers year over year, contributing 8% to total revenues. Notably, 92.2% of its revenue came from recurring sources, indicating a growing dependency on cloud services for its business model.

January 2025 saw the launch of the advanced Synchronoss Personal Cloud platform at CES 2025. This platform features AI-powered photo editing, a user-friendly interface, and sophisticated backup options.

Offered globally through carriers like AT&T, Verizon (VZ), and SoftBank, it now serves over 11 million subscribers, highlighting features such as iPhone storage optimization and enhanced folder backup for Android devices.

The platform emphasizes data privacy and security, providing users with an ad-free environment and customizable management options for their digital content.

Growing Clientele Enhances SNCR’s Future Outlook

A strong partner network has been essential for SNCR’s growth trajectory. The company anticipates expanding its customer base for its personal cloud solutions, which are compatible with smartphones, tablets, and computers. Major clients include Verizon and AT&T.

In December 2024, SNCR secured a three-year contract extension with a prominent U.S. telecom provider for its Personal Cloud solution. This deal facilitates secure content management and sharing across multiple devices and the cloud.

An impressive 75% of Synchronoss Technologies’ revenues are now under long-term contracts, providing substantial top-line visibility.

Additionally, in Q3 of 2024, SNCR signed a contract extension with SFR, part of Altice France, which serves over 27 million users. This partnership further establishes SNCR’s presence within SFR’s operational ecosystem, demonstrating customer satisfaction and the efficacy of their cloud offerings.

Earnings Estimates Indicate Mixed Prospects for SNCR

The Zacks Consensus Estimate forecasts full-year 2025 revenues at $180.87 million, reflecting a year-over-year growth rate of 4.53%.

Projected earnings for 2024 stand at $1.46 per share, marking a sharp increase of 9.7% over the past month and signifying a remarkable 99.32% rise from the previous year.

For detailed EPS estimates and surprises, check the Zacks Earnings Calendar.

Should Investors Consider SNCR Stock?

Currently, SNCR shares are trading at a substantial discount, which is evident from their Value Score of A.

The stock’s forward Price/Sales ratio is at 0.52, significantly lower than the industry average of 2.96.

With a strong pipeline of new customer possibilities, ongoing product innovations—especially in AI and cloud offerings—and a dedication to enhancing user experience and security, SNCR is well-positioned for continued revenue growth and market positioning in the cloud solutions arena. Its attractive valuation presents a compelling opportunity for investors.

Currently, Synchronoss Technologies holds a Zacks Rank of #1 (Strong Buy). You can find the complete list of today’s Zacks #1 Rank stocks here.

Explore Investment in Tomorrow’s Power Source

The need for electricity is growing rapidly, prompting a shift away from fossil fuels like oil and natural gas. Nuclear energy is emerging as a prime alternative.

Recently, leaders from the U.S. and 21 other nations made a pact to TRIPLE global nuclear energy capacities. This bold move could lead to significant profits for investors involved in nuclear-related stocks.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, details the key players and technologies propelling this shift, along with three standout stocks poised for major growth. Download it free today.

Want the latest recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Synchronoss Technologies, Inc. (SNCR): Free Stock Analysis Report

Dropbox, Inc. (DBX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.