Smith & Nephew (SNN) has acquired Integrity Orthopaedics for a total consideration of $450 million, including an upfront payment of $225 million and additional performance-based milestones over the next five years. This acquisition, announced recently, is expected to close before the end of January 2026 and aims to enhance SNN’s presence in the growing shoulder repair market.

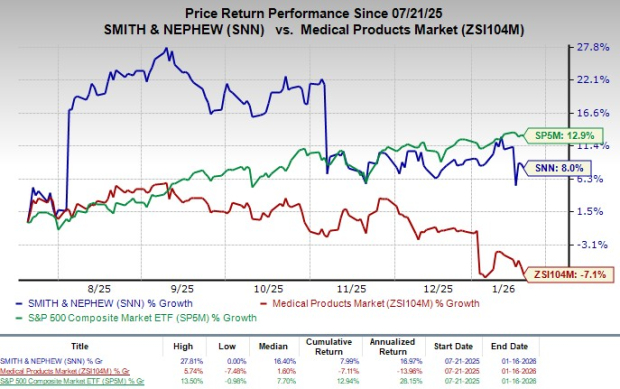

With approximately 500,000 rotator cuff repair (RCR) procedures performed annually in the U.S., equating to an estimated market opportunity of $875 million, SNN’s acquisition is strategically significant. The Tendon Seam rotator cuff repair system, designed to lower re-tear rates and improve surgical outcomes, will complement SNN’s existing product offerings in the shoulder arena. Currently, SNN maintains a market capitalization of $13.89 billion and has seen its shares increase by 8% over the past six months.

Management forecasts that the acquisition will be accretive to profit margins by 2028 and will be financed through existing cash, thus preserving balance sheet flexibility. SNN’s strategy aligns with leveraging high-impact innovations to deepen its leadership in shoulder repair while addressing the operational failures associated with traditional techniques.