Hitting the Mark

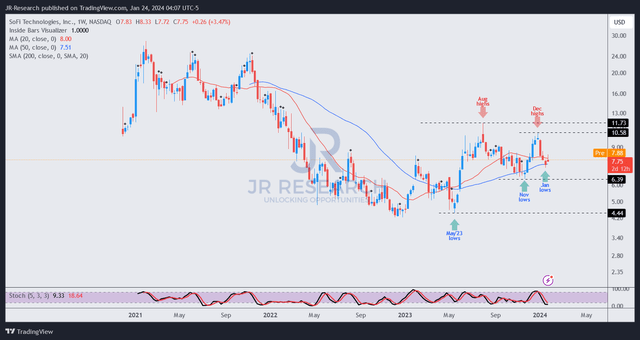

It’s time to celebrate for enthusiasts of SoFi Technologies, Inc. (NASDAQ:SOFI) as the mid-November 2023 forecast hit the nail on the head. The stock stood strong at the $6.50 level, a testament to the robust support from avid SOFI buyers. The remarkable outperformance against sector peers indicated a continued journey towards GAAP net income profitability.

Market Fluctuations & Resilience

Subsequently, the stock experienced a soaring 65% surge through late December 2023 before undergoing a slight dip in January 2024. Despite this, amidst the market downturn, SoFi has retraced its steps to levels witnessed in late November 2023, relinquishing the December gains.

Confidence Amidst Uncertainty

Contrary to the apprehension voiced by bearish SOFI investors, it’s crucial for market participants to closely monitor SOFI’s price movements and its improving fundamentals. The imminent fourth-quarter earnings release on January 29 and the bright outlook are crucial factors. Analysts are anticipating FY23 net revenue of $2.06 billion and an adjusted EBITDA of $393 million, surpassing the midpoint of SoFi’s FY23 guidance outlined during its Q3 earnings conference.

Strategic Insight and Concerns

The market presently seems to have undervalued SOFI ahead of its pivotal Q4 release, despite management’s unwavering confidence in achieving GAAP net income profitability. The market’s tepid response is perplexing, particularly given SOFI’s 32% surge over the past year, notwithstanding a recent bear market pullback of more than 25% from its December 2023 highs.

Notably, recent uncertainties on fair value accounting policies have prompted conflicting sentiments and impact assessment. KBW analysts have recalibrated SoFi’s forecasts for 2024, cautioning that “rate cuts could adversely affect earnings due to SoFi’s fair value accounting practices.” Hence, the market is now deliberating on the sustainability of SoFi’s GAAP profitability guidance in light of potential Fed rate cuts in 2024.

Market Dynamics and Growth Potential

Despite the prevailing uncertainties, management’s proficiency in enhancing cross-selling monetization opportunities from its high-income customer base and capitalizing on the resurgence in student loan refinancing could bolster SOFI’s trajectory. Additionally, SOFI’s deposit base increment to $15.7 billion as of Q3 serves as a strategic pillar for growth and normalization against the negative impact of potential decreases in interest income.

Market Position and Potential

The market has favorably priced SOFI for growth, as indicated by Seeking Alpha’s Quant, assigning it an “A+” growth grade. This is further emphasized by its “C” valuation grade, signifying a reasonable valuation relative to its growth potential. Despite a potential underestimation of its GAAP profitability trajectory, the recent entry into a bear market from its December 2023 highs may signify a turn of the tide.

Resilience Amidst Market Volatility

The robust process of SOFI’s recuperation from its November 2023 low ($6.50 level), its resilience over the market, and the resurgence above the $7.20 level refute the notion of an irrevocable downfall. Even amidst market flux, it remains comfortably supported above its 50-week moving average, affirming its medium-term upward trajectory. Therefore, the temporary setback should serve as a constructive force, tempering the recent exuberance as we approach SoFi’s Q4 earnings release and FY2024 guidance.

Seizing the Opportunity

Despite the slight pullback, investors have an opportunity to partake in the potential upswing by acquiring positions during this bear market phase.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Feedback and Engagement

Do you have constructive commentary to enhance the thesis, perceive any critical gaps, or recognize significant insights not covered? Whether you agree or disagree, your contribution could enrich the community’s learning experience! Share your perspective below!