SoFi Technologies (NASDAQ: SOFI) has been a prominent player in the stock market, soaring by 85% since the beginning of 2023. The fintech’s strategic overhaul has borne fruit, as evidenced by its recent groundbreaking achievement of entering the profit zone for the first time in its history.

SoFi’s Evolution into a Comprehensive Financial Services Firm

Established in 2011, SoFi initially focused on aiding individuals in refinancing their student loans. However, as the pandemic disrupted the financial landscape in 2020, it necessitated a reassessment of the company’s dependence on student loans. SoFi promptly diversified its portfolio by venturing into personal loans, a move that witnessed a staggering 430% surge in loan origination by 2023. Furthermore, with the acquisition of Golden Pacific Bancorp in 2022, SoFi significantly augmented its capabilities and transformed from a lending entity to a one-stop-shop for diverse financial requirements. The assimilation of the bank provided SoFi with a banking license, authorizing it to offer a broad spectrum of banking products and services, including checking and savings accounts, credit and debit cards, investment facilities, and technological solutions.

Image source: Getty Images.

The acquisition of the bank also enabled SoFi to amass deposits, fortifying its funding base. By retaining the loans on its books, SoFi was able to capitalize on the prevailing high-interest-rate environment, resulting in a 116% surge in net interest income to $1.3 billion the previous year.

The Turning Tide for SoFi

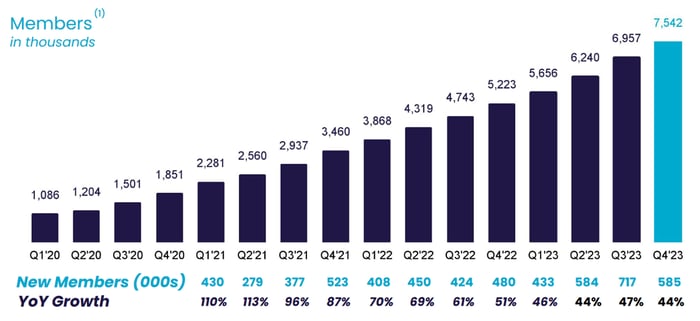

SoFi’s standout feature lies in its remarkable growth trajectory. The company’s customer base, which comprises over 7.5 million customers termed as “members,” witnessed a robust 44% surge year over year, reaching a record high at the end of last year. Notably, SoFi has consistently added members, experiencing a growth rate of 10% or more in every quarter, with only one exception, over the past 15 quarters.

Image source: SoFi Technologies annual report.

Despite its rapid expansion, SoFi has grappled with escalating expenses. While it has exponentially increased its revenue by 303% since 2019, it has yet to achieve a full-year profit. However, a flicker of optimism emerged as the company reported a net profit of $48 million in the fourth quarter, marking its debut profitable quarter. SoFi management also expressed optimism, projecting a GAAP net income of $95 million to $105 million in 2024.

Investing Perspective on SoFi

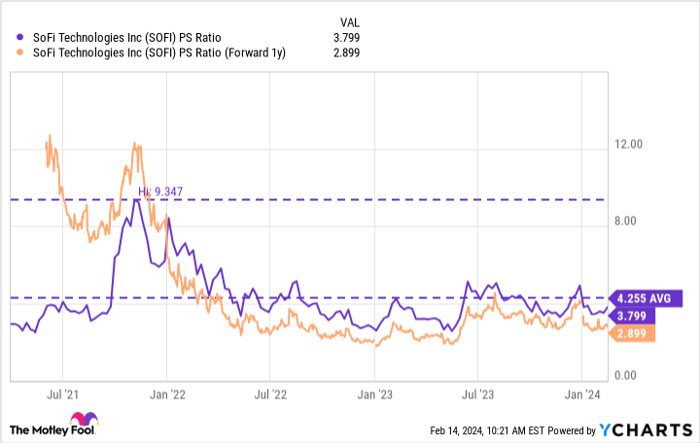

Following SoFi’s maiden profitable quarter, now could be an opportune moment for investors to contemplate adding the stock to their portfolios. Presently, the company’s stock is valued at 3.7x sales, which is below its average price-to-sales ratio (P/S) of 4.3 since its IPO in 2020.

SOFI P/S Ratio data by YCharts.

Despite SoFi’s stock being relatively expensive compared to other bank stocks, the company has exhibited remarkable growth amidst rising interest rates, enticing customers with high-yield savings accounts. Given its ability to outpace traditional banks in terms of growth, the premium valuation is justified. While this valuation might expose the stock to heightened volatility in the short term, I believe SoFi’s sustained growth makes it an attractive proposition for patient investors.

Should you invest $1,000 in SoFi Technologies right now?

Before delving into SoFi Technologies stock, it’s worth considering that the Motley Fool Stock Advisor analyst team recently identified what they regard as the 10 best stocks for investors to buy at present, with SoFi Technologies not making the cut. The selected 10 stocks are poised to yield substantial returns in the foreseeable future. The Stock Advisor service furnishes investors with a user-friendly roadmap for success, encompassing portfolio construction guidance, regular insights from analysts, and two fresh stock picks each month. Since 2002, the Stock Advisor service has surpassed the S&P 500’s return by over threefold*.

Discover the 10 stocks

*Stock Advisor returns as of February 12, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.