“`html

SolarMax Technology Reports Strong Q1 2025 Financial Results

SolarMax Technology, Inc. has released its first quarter 2025 financial results, showing notable revenue growth and a significantly reduced net loss, despite ongoing regulatory challenges.

Financial Overview

For Q1 2025, SolarMax reported revenue of $6.9 million, up from $5.8 million the previous year. The company’s gross profit reached $1.4 million, shifting from a loss of $0.5 million during the same quarter in 2024. Operating expenses were cut from $18.4 million to $2.6 million, resulting in a net loss of $1.3 million, a drastic improvement from a net loss of $19.3 million a year prior. CEO David Hsu conveyed optimism regarding the company’s operational efficiency, despite challenges posed by California’s NEM 3.0 policy affecting residential solar demand. The firm is now prioritizing the expansion of its commercial solar and battery system projects, looking toward long-term growth and diversification, though it has yet to finalize contracts.

Key Highlights

- Revenue grew by 20%, reaching $6.9 million compared to $5.8 million in Q1 2024.

- Gross profit increased to $1.4 million from a loss of $0.5 million in Q1 2024.

- Operating expenses dropped to $2.6 million, down from $18.4 million in the year-ago period, reflecting improved cost management.

- Net loss is now $1.3 million, or $0.03 per share, significantly improved from a net loss of $19.3 million, or $0.46 per share in Q1 2024.

Challenges Ahead

- Despite revenue growth, the company still reported a net loss of $1.3 million, indicating ongoing financial challenges.

- California’s NEM 3.0 policy presents challenges to residential solar demand, suggesting potential market difficulties ahead.

- SolarMax has not secured contracts for its planned commercial projects, raising concerns about the timing and viability of its growth strategies.

FAQs

What were SolarMax’s revenue figures for Q1 2025?

SolarMax reported revenue of $6.9 million for Q1 2025, an increase from $5.8 million in Q1 2024.

How much did SolarMax improve its gross profit?

Gross profit for Q1 2025 was $1.4 million, significantly up from a loss of $0.5 million in Q1 2024.

What challenges is SolarMax facing in the solar market?

The company is encountering challenges due to California’s NEM 3.0 policy, which reduces compensation for homeowners providing excess solar power.

What growth opportunities is SolarMax pursuing?

SolarMax is focusing on commercial and industrial solar projects in hopes of achieving growth and diversification.

Who is the CEO of SolarMax Technology, Inc.?

David Hsu serves as CEO and has expressed optimism regarding the firm’s recent performance and outlook.

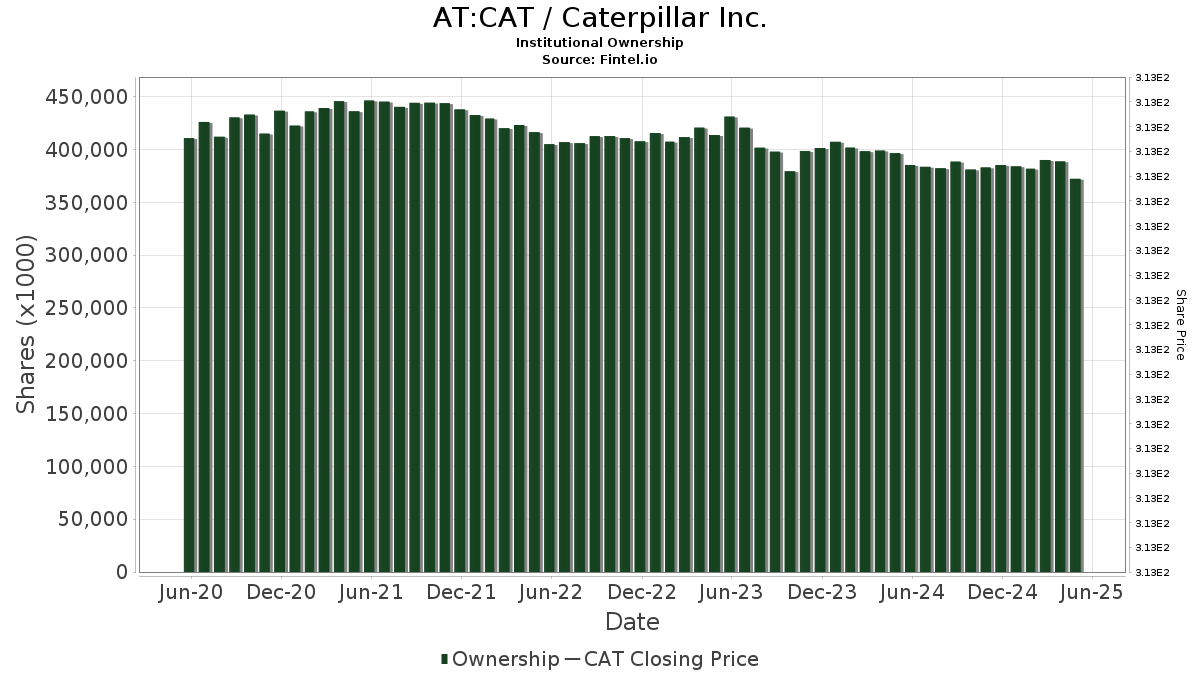

Institutional Shareholder Activity

In the latest quarter, 20 institutional investors acquired shares of $SMXT, while 23 reduced their holdings.

- BLACKROCK, INC. added 294,983 shares (+31.0%) in Q1 2025, totaling an estimated $353,979.

- EXODUSPOINT CAPITAL MANAGEMENT, LP removed 181,846 shares (-100.0%) in Q4 2024, valued at approximately $294,590.

- MORGAN STANLEY added 150,391 shares (+243.1%) in Q1 2025, for an estimated $180,469.

- UBS GROUP AG reduced its holdings by 82,272 shares (-20.1%) in Q1 2025, worth an estimated $98,726.

- VANGUARD GROUP INC added 81,288 shares (+41.4%) in Q1 2025, totaling an estimated $97,545.

- HRT FINANCIAL LP divested 74,166 shares (-100.0%) in Q4 2024, valued at $120,148.

- JPMORGAN CHASE & CO reduced its stake by 55,051 shares (-50.4%) in Q1 2025, equating to an estimated $66,061.

Full Financial Results Announcement

RIVERSIDE, Calif., May 16, 2025 (GLOBE NEWSWIRE) — SolarMax Technology, Inc. (Nasdaq: SMXT) has disclosed its financial outcomes for the quarter ending March 31, 2025.

First Quarter 2025 Financial Highlights

- Revenue: $6.9 million compared to $5.8 million in Q1 2024.

- Gross profit: $1.4 million versus ($0.5) million in Q1 2024. Note that last year’s cost of revenues included a one-time, non-cash Stock-based compensation expense of $1.3 million.

- Total operating expense: $2.6 million, down from $18.4 million in Q1 2024. Last year’s figure also included a one-time, non-cash Stock-based compensation expense of $15.9 million.

- Net loss: $1.3 million or $0.03 per share, compared to a net loss of $19.3 million or $0.46 per share in Q1 2024.

David Hsu, CEO of SolarMax, commented, “We are encouraged by our progress this quarter, having achieved a 20% increase in revenue and an improved gross margin despite ongoing inflationary and regulatory pressures. This progress reflects our team’s capabilities in navigating a dynamic market while enhancing operational efficiency and enforcing cost containment initiatives.”

“Although California’s NEM 3.0 policy—which significantly reduced compensation for homeowners sending excess solar power to the grid—continues to impact residential solar demand, we’re gaining traction through our dealer network and our proposed commercial projects,” noted Hsu. “We are establishing a foundation for commercial and industrial solar and battery system projects, which we see as a growth opportunity. While we lack executed contracts, our development pipeline remains active as we aim for longer-term diversification and growth.”

About SolarMax Technology Inc.

SolarMax, founded in 2008 and based in California, focuses on making sustainable energy accessible and affordable within the solar and renewable energy sector. The company has built a solid presence in Southern California and aims to expand its commercial solar development and LED lighting solutions in the U.S., while also expanding its residential solar operations.

Forward-Looking Statements

This press release contains forward-looking statements regarding future operations and performance that involve risks and uncertainties. Actual results may vary from those predicted.

“`# Understanding SolarMax’s Forward-Looking Statements and Risks

SolarMax provides forward-looking statements as defined by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are meant to fall within the safe harbor established by these sections. Generally, forward-looking statements, which detail the Company’s strategies and expectations, can be recognized by terms like “believe,” “expect,” “may,” “will,” and similar expressions. Notably, not every forward-looking statement includes such identifying words.

All assertions besides historical facts in this release regarding SolarMax’s strategies, prospects, financial conditions, operations, costs, plans, and objectives are classified as forward-looking statements. Several significant factors could lead to actual results and financial status differing materially from those expressed in these statements. The risks and uncertainties may involve the Company’s success in growing its commercial solar business and gaining acceptance as a solar systems provider in the United States. Additional challenges include the Company’s ability to restart operations in China, where it hasn’t generated revenue since 2021, and adapting to changes in governmental policies related to renewable energy.

For further details on risks, refer to “Cautionary Note on Forward-Looking Statements,” “Item 1A. Risk Factors,” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” found in the Company’s Annual report on Form 10-K for the year ending December 31, 2024, filed with the SEC on March 31, 2025. SolarMax does not commit to updating or revising any forward-looking statements following new information or future events, except as legally required. Readers should acknowledge that actual future results may substantially differ from anticipated outcomes.

Contact:

For more information, contact:

Stephen Brown, CFO

(951) 300-0711