SoundHound AI Shares Climb 12.1% Post Strong Earnings Report

SoundHound AI (SOUN) has seen its shares rise by 12.1% after announcing its fourth-quarter 2024 results on February 27, 2025.

Click here to check the details of SOUN’s fourth-quarter 2024 results.

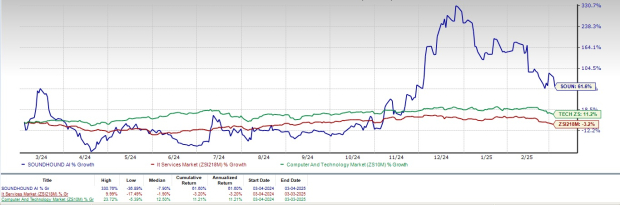

Remarkable Stock Performance Outshines Sector

Over the past year, SOUN shares have surged 61.6%, significantly outperforming the broader Zacks Computer & Technology sector, which saw an increase of 11.2%, and the Zacks Computers – IT Services industry, which declined by 3.2%. This growth stems from the escalating demand for SoundHound’s AI solutions and voice AI technologies across diverse industries, evident from major customer wins and expanded partnerships. Notably, adoption in quick-service restaurants, in-vehicle voice commerce, and advancements in generative AI have propelled this success.

SOUN’s Expanding Portfolio Boosts Growth Prospects

In the fourth quarter of 2024, SoundHound expanded its presence in the restaurant sector, securing partnerships with well-known chains such as Burger King in the UK, along with Whataburger, Peet’s Coffee, and Torchy’s Tacos.

Due to these recent gains, the company has established itself as the leading provider of AI-powered customer service within the restaurant industry, with over 10,000 locations utilizing its technology. This widespread adoption emphasizes the rising demand for AI automation in food services, enhancing operational efficiency and customer experience.

In February 2025, SoundHound launched the next generation of its voice AI-powered restaurant platform, enhancing its Dynamic Drive-Thru solution with improved accuracy, speed, and omnichannel ordering capabilities. Additionally, AI automation was extended to services such as Call-to-Order, Text-to-Order, Scan-to-Order, and In-Car Voice Ordering.

SoundHound’s technology is also advancing in the public sector. In the fourth quarter of 2024, the company signed a contract with the City of Coral Springs and continued collaborations with federal agencies and General Dynamics to implement conversational AI solutions.

Growing Partner Base Strengthens Market Position

SoundHound’s expanding clientele includes prominent companies like Rekor Systems (REKR) and Lucid Group (LCID). These partnerships solidify its stance in the AI-driven voice technology market and elevate its product offerings across various sectors.

The collaboration with Rekor Systems integrates its vehicle recognition software, Rekor Scout, with SoundHound’s voice AI, creating hands-free systems for law enforcement and first responders. This initiative aims to enhance the efficiency and safety of emergency vehicles during critical operations.

Similarly, SoundHound partnered with Lucid Group to roll out the Lucid Assistant, a hands-free voice control system for vehicles. Powered by SoundHound Chat AI combined with generative AI technology, this assistant enriches the in-vehicle experience through real-time data and user-friendly controls.

Additionally, collaborations with notable firms like NVIDIA (NVDA), ARM, Perplexity, Olo, and Oracle are broadening SoundHound’s capabilities. The recent launch of an advanced in-vehicle voice assistant backed by NVIDIA DRIVE incorporates real-time and generative AI for seamless offline vehicle intelligence and personalized assistance.

SoundHound Boosts 2025 Revenue Guidance

SoundHound projects its 2025 revenues to range between $157 million and $177 million, reflecting a year-over-year growth of 97%.

The current Zacks Consensus Estimate for 2025 revenues stands at $163.64 million, suggesting a 93.21% increase compared to the previous year. Meanwhile, the consensus loss estimate has decreased by 3 cents over the past month, now pegged at 24 cents per share, indicating a 76.92% increase year over year.

SoundHound AI, Inc. Price and Consensus

SoundHound AI, Inc. price-consensus-chart | SoundHound AI, Inc. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

SOUN’s Valuation Indicates Caution for Investors

It is important to note that SOUN shares are currently trading at a premium. The Value Score of F suggests a stretched valuation at this time. SOUN’s forward 12-month Price/Sales ratio stands at 23.92X, surpassing the industry average of 19.74X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Investment Considerations for SOUN

SoundHound’s impressive growth, strategic partnerships, and innovative technology position it as a significant player in the AI-driven voice technology landscape. However, increasing competition in the AI sector, particularly in areas like customer service and voice assistance, may impact SOUN’s performance.

Moreover, the GAAP gross margin for the fourth quarter of 2024 fell to 40%, down from the previous year, largely due to shifts in business and product mix following recent acquisitions. SoundHound’s current Growth Score of F indicates that it may not be an ideal choice for growth-focused investors, raising concerns over its valuation.

Presently, SOUN holds a Zacks Rank of #3 (Hold), suggesting investors should wait for a more favorable entry point before engaging with the stock. For more insights, you can see today’s Zacks #1 Rank (Strong Buy) stocks here.

Unlock All Zacks Buys and Sells for Just $1

We’re not kidding.

Years ago, we surprised our members by offering 30-day access to all our picks for just $1. There’s no obligation to spend further.

Thousands have benefited from this offer, while others hesitated, believing there had to be a catch. Our intent is clear: we want you to get familiar with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others that closed 256 positions with double- and triple-digit gains in 2024 alone.

To stay updated with Zacks Investment Research recommendations, download the 7 Best Stocks for the Next 30 Days today. Click for your free report.

NVIDIA Corporation (NVDA): Free Stock Analysis report.

Rekor Systems, Inc. (REKR): Free Stock Analysis report.

Lucid Group, Inc. (LCID): Free Stock Analysis report.

SoundHound AI, Inc. (SOUN): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.