Investors Eye Promising Niche Players SoundHound AI and BigBear.ai

As artificial intelligence (AI) continues to transform various sectors, investors are increasingly focusing on niche AI companies with strong growth potential. Two notable players—SoundHound AI (SOUN) and BigBear.ai (BBAI)—have emerged as key contenders in the AI landscape. Although differing in size, both companies maintain a strong emphasis on their AI specialties: SoundHound excels in voice and conversational AI, while BigBear.ai specializes in data-driven “decision intelligence” solutions for enterprises and government. Remarkably, SoundHound’s market capitalization soared past $3 billion in 2024, establishing it as a mid-cap firm, while BigBear.ai remains a small-cap player with a market value around $743 million.

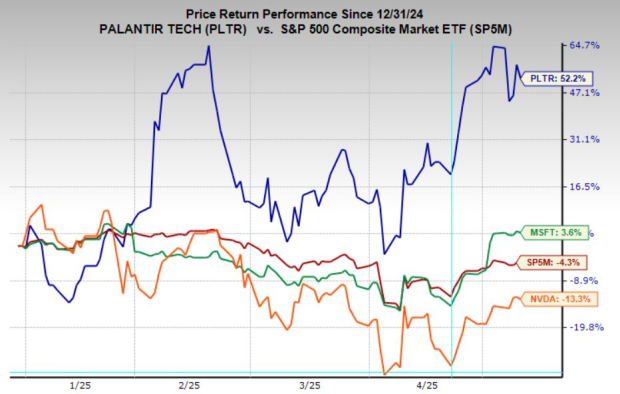

SoundHound’s stock experienced an incredible 836% increase in 2024 due to rapid revenue growth, while BigBear.ai also gained nearly 108%. However, both stocks have recently faced sharp declines, with SoundHound shares down 59% in 2025, slightly more than BigBear.ai’s decline of approximately 42.2%.

SOUN & BBAI Stock Performances

Image Source: Zacks Investment Research

Given the recent performance, investors may wonder which of these AI plays presents a better opportunity for recovery. Here, we will evaluate their fundamentals, growth outlook, and associated risks.

The Case for SOUN Stock

SoundHound AI has established itself as a leader in voice-enabled AI technologies, with its platform gaining traction across various industries. Its core platform allows businesses to integrate conversational voice assistants into products ranging from automobiles to customer service applications. As a result, SoundHound witnessed a remarkable 85% increase in revenues in 2024, reaching $84.7 million. The fourth quarter saw revenues climb to $34.5 million, a staggering 101% year-over-year growth, prompting management to revise their outlook for 2025 upwards.

A significant achievement for SoundHound has been its effort to diversify its client base, reducing reliance on a small number of customers. In 2024, its largest client’s contribution to revenues decreased to just over 14% from nearly 50% in 2023. The total reliance on its top five clients dropped from over 90% to approximately one-third, demonstrating substantial progress in diversifying revenue streams.

SoundHound’s client roster includes major players across various sectors. It powers voice AI systems in automotive infotainment, drive-through restaurant kiosks, and banking applications. Notably, the company collaborates with over 30% of the top 20 quick-service restaurant chains and 70% of the leading global financial institutions. Recently, SoundHound expanded its automotive partnerships, securing deals with six additional Stellantis brands for in-car voice assistants. Additionally, the company announced a new partnership with Tencent Holdings’ (TCEHY) Intelligent Mobility unit to provide its voice technology for in-car assistance in China. To enhance its offerings, SoundHound has further integrated NVIDIA AI Enterprise tools into its platform.

Despite this technological edge and sales growth, SoundHound continues to face challenges. Like many emerging tech firms, it is burning cash and contending with intensive competition. Major players in the “Magnificent Seven,” including Amazon (AMZN), Alphabet (GOOGL), and Apple (AAPL), are all actively investing in similar conversational AI capabilities, which may create pressures for independent firms. SoundHound aims to distinguish itself by offering an independent platform without ceding control to larger tech companies.

Moreover, if economic conditions deteriorate or spending slows, clients in sectors such as automotive and retail could reduce investment in new technologies. Management has pointed out that economic factors like tariffs affecting auto manufacturers (e.g., Stellantis) could impact the demand for SoundHound’s services. To maintain investor confidence, the company needs to sustain its growth momentum and move toward profitability.

The Case for BBAI Stock

BigBear.ai, a smaller yet notable company, has established a significant niche in AI services for the government and enterprise sectors. It positions itself as a specialized AI provider with a focus on decision intelligence, leveraging AI and machine learning to assist organizations in making more informed data-driven decisions. Its solutions are utilized in crucial sectors such as defense, intelligence, cybersecurity, and logistics.

This specialized focus has led to notable contract wins and a growing backlog of orders. By the end of 2024, BigBear’s backlog reached $418 million, a substantial increase from $168 million the previous year. This growth offers the company considerable revenue visibility moving forward. Additionally, BigBear has begun securing larger, longer-term contracts, reflecting increasing client trust; for instance, the U.S. Department of Defense awarded BigBear.ai a 3.5-year, $13.2 million sole-source contract to support a Joint Chiefs of Staff initiative in March 2025.

Furthermore, BigBear.ai has established partnerships with industry giants like Amazon and Palantir Technologies Inc. (PLTR), underscoring the validity of its technology. Amazon Web Services has integrated BigBear’s ProModel simulation software into its lineup to enhance AI-driven logistics. Similarly, Palantir is collaborating with BigBear to strengthen AI capabilities targeted at defense and intelligence applications.

Despite promising prospects, BigBear.ai faces significant near-term hurdles. The company reported an alarming net loss of $108 million in the fourth quarter of 2024, partially attributed to a $93 million non-cash charge linked to a new convertible note. Operating expenses, particularly selling, general, and administrative costs, rose sharply to $22.2 million from $18.2 million the previous year, partly due to integration costs associated with recent acquisitions, including Pangiam. Consequently, adjusted EBITDA fell from $3.7 million the prior year to only $2 million in the fourth quarter.

Management anticipates continued negative adjusted EBITDA in 2025 as investments in operations persist. Consequently, BigBear is still a ways off from achieving profitability, which introduces a level of risk amid fluctuating market conditions.

Moreover, the company’s heavy reliance on U.S. government contracts poses risks, especially given budget uncertainties exacerbated by stopgap funding measures in Congress. These uncertainties could lead to delays in contract awards and spending. Additionally, the presence of convertible notes maturing in 2029, associated with the substantial derivative loss, raises concerns about the company’s capital structure. Poor management might dilute shareholders or strain finances further.

SoundHound and BigBear.ai: Earnings Estimates and Future Growth Projections

SoundHound AI and BigBear.ai are under scrutiny as analysts assess their financial outlooks. Both companies must demonstrate they can convert backlogs into profitable growth.

Earnings Estimates and Growth Rates for SOUN and BBAI

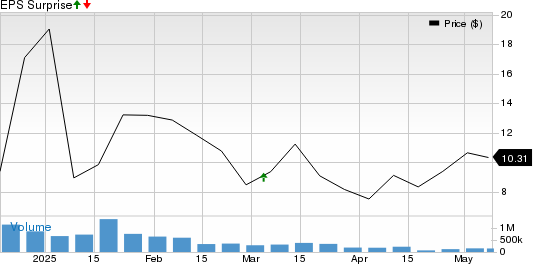

SOUN Stock

Analysts are becoming more optimistic about SoundHound’s earnings. Over the last 60 days, the Zacks Consensus Estimate for its 2025 loss per share narrowed from 27 cents to 16 cents, indicating a positive shift in sentiment. To view the latest EPS estimates and surprises, visit the Zacks earnings calendar.

Image Source: Zacks Investment Research

BBAI Stock

For BigBear.ai, the Zacks Consensus Estimate for the 2025 loss per share stands at 21 cents, which has widened by two cents in the past two months.

Image Source: Zacks Investment Research

The growth rates for the two companies show a clear contrast. For 2025, analysts expect BigBear’s revenues to climb 5.7% to $167.2 million. In comparison, SoundHound aims to nearly double its revenue this year to $165.8 million, representing a staggering increase of 95.7%. This slower growth, combined with sustained losses, raises investor caution regarding BBAI.

Valuation of SOUN and BBAI Stocks

After a remarkable surge last year, SoundHound’s stock valuation seems quite high. Even following a pullback, it is trading at around an 18X forward 12-month price-to-sales (P/S) ratio, which is substantial for a company still in the red. The current Value Score for SOUN indicates it is overvalued, rated at an F.

The positive news is SoundHound projects to double its revenues in 2025, with guidance of $157-$177 million, nearly twice the sales expected for 2024. This strong growth could improve the valuation over time.

Image Source: Zacks Investment Research

BBAI is currently trading at a 4.24X P/S ratio, which is above its median of 2.23X but lower than the industry’s average of 16.15X and the Zacks Computer and Technology sector’s 5.1X. BBAI also holds a current Value Score of F. The company may need to show clear signs of improved execution or a change in federal spending trends to regain positive market momentum.

Image Source: Zacks Investment Research

Conclusion

Evaluating both companies indicates that SoundHound AI, with a Zacks Rank #3 (Hold), has a stronger fundamental profile. Key differences include SoundHound’s solid revenue growth, expansion into various industries, and strong liquidity—factors that contribute to positive market momentum.

In contrast, BigBear.ai, ranked #4 (Sell) by Zacks, is experiencing slower growth and larger immediate losses. While its low valuation and notable partnerships could be promising, translating them into stock gains may take longer.

For those interested, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market, averaging an annual gain of +23.9%. It’s advisable to monitor these seven stocks closely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Apple Inc. (AAPL): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

Palantir Technologies Inc. (PLTR): Free Stock Analysis report

BigBear.ai Holdings, Inc. (BBAI): Free Stock Analysis report

SoundHound AI, Inc. (SOUN): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.