Nvidia’s Dominance in AI: A Lesson for Potential Investors

In just a few years, Nvidia (NASDAQ: NVDA) has emerged as one of the top investment choices. The company reached a market cap of over $1 trillion, and its valuation has continued to rise impressively. It’s uncertain how high its stock could climb in the long run.

The Rise of Nvidia: Powered by AI

The significant growth in Nvidia’s stock can be attributed primarily to the booming field of artificial intelligence (AI). As the leading provider of AI GPUs, Nvidia has capitalized on a pivotal moment in technology. Experts predict that spending on AI infrastructure will surge, likely benefiting Nvidia extensively.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Seeking the Next Big AI Stock: Meet SoundHound AI

If you are on the hunt for the next significant AI stock, consider SoundHound AI (NASDAQ: SOUN). The company’s stock has risen sharply this year, but there remains considerable potential upside if it can address several key growth areas.

SoundHound AI: An Early Player in the AI Market

Early movers often have the best chances of success in the AI sector. Nvidia invested heavily in research and development to launch its initial AI GPUs. Though demand was slow to take off, this groundwork enabled Nvidia to build a solid base of users and data, helping it refine its future products.

Today, Nvidia dominates between 70% to 95% of the AI GPU market, a lucrative field that supports its ongoing R&D efforts. This early investment proved to be a strategic advantage as the industry expanded rapidly.

SoundHound AI shares a similar advantage. The company specializes in sound and AI technology, offering voice recognition and natural language processing suitable for multiple sectors.

Fast food chains are now testing SoundHound AI’s technology at drive-thru locations, aiming to reduce costs and enhance efficiency. Additionally, automakers are integrating this software into their cars, allowing drivers to interact about maintenance and road conditions. The company’s technology is also widely adopted in customer support, assisting businesses with phone and online interactions.

These business relationships are grounded in years of development. Since its founding in 2005, SoundHound AI has amassed over 200 patents. Its launch of an open developer platform in 2016 marked a significant turning point for its sales, leading to contracts with numerous clients over the past decade.

Like Nvidia, SoundHound AI benefits from the data and credibility those client relationships provide. Real-world applications enhance the effectiveness of its models and reassure potential customers about the value of its technology.

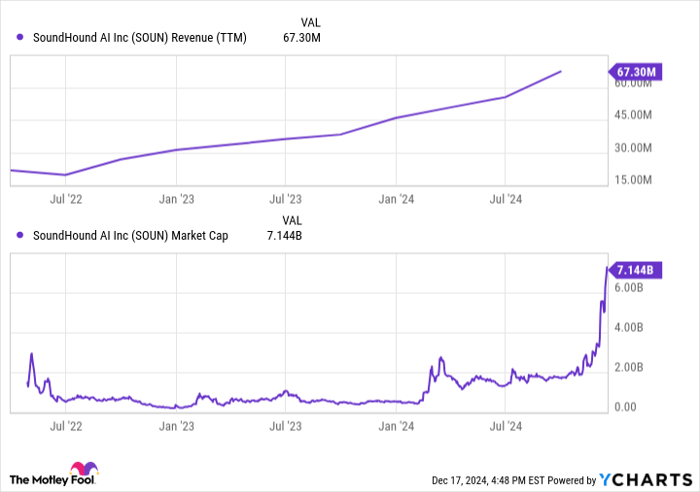

SOUN Revenue (TTM) data by YCharts

Can SoundHound AI Achieve 1,000% Growth?

Unlike Nvidia, SoundHound AI is currently operating at a loss. Despite a significant revenue spike, it anticipates generating less than $190 million in sales next year, with a research and development budget of only $64 million over the past year.

SoundHound AI indeed holds an early advantage in its market segment. However, if larger tech companies decide to enter this niche, SoundHound AI may struggle to compete financially. Concerns about its steep valuation add another layer of caution; shares are currently trading at 88 times sales, a figure few companies can maintain over time, even Nvidia as an exception.

Is it feasible for SoundHound AI to mirror Nvidia’s historic success? Probably not. The sound AI market is markedly smaller than the AI GPU sector. While the stock appeared enticing in September at a valuation under $2 billion, its current price exceeding $7 billion reduces its appeal as an investment.

It may be worth monitoring this AI player should its shares decline. However, given its less favorable growth expectations compared to Nvidia and an inflated valuation, I will refrain from investing in SoundHound AI at this time.

Is Now the Right Time to Invest $1,000 in SoundHound AI?

Before considering an investment in SoundHound AI, keep the following in mind:

The Motley Fool Stock Advisor analyst team recently identified their 10 best stocks to buy now, and SoundHound AI did not make the cut. The chosen stocks have the potential for substantial returns in the future.

Reflect on Nvidia’s listing on April 15, 2005… a $1,000 investment at that time would now be worth $790,028!*

Stock Advisor provides investors with a clear strategy for success, including advice on portfolio building, regular analyst updates, and two new stock recommendations each month. This service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.