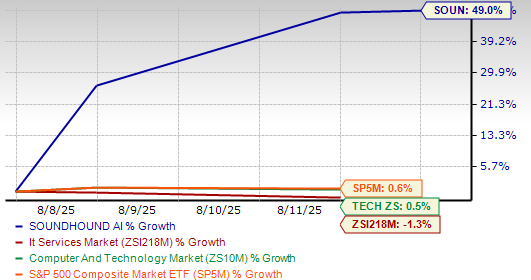

SoundHound AI, Inc. (SOUN) reported its strongest-ever second-quarter results on August 7, posting revenue of $42.7 million, a 217% year-over-year increase, and exceeding estimates by nearly $10 million. While the stock has rallied 49% in the past week, it remains 36% below its 52-week high of $24.98 and 270% above its low of $4.32.

SoundHound’s growth was driven by its Enterprise AI, Restaurant, and Automotive segments, with over 1 billion monthly queries and more than 14,000 active restaurant locations utilizing its voice AI. The company raised its 2025 revenue guidance to between $160 million and $178 million, targeting adjusted EBITDA profitability by year-end.

Despite strong momentum, SOUN’s valuation is elevated with a forward price-to-sales ratio of 33.34, nearly double the industry average of 16.74. Risks include competitive pricing pressures and dependence on large enterprise deals. The Zacks Consensus Estimate for the 2025 loss per share has improved to 15 cents from 16 cents, but investors are advised to be cautious given the stock’s recent surge.