Southern Copper Posts Strong Q4 Earnings Amid Sales Rise

Southern Copper Corporation (SCCO) reported fourth-quarter 2024 earnings of $1.01 per share, slightly missing the Zacks Consensus Estimate of $1.02. However, this result marks a remarkable 74% increase compared to the same quarter last year. Increased sales of copper, zinc, and silver, along with higher prices, drove these results. Nonetheless, a decline in molybdenum sales volume impacted performance.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Sales Volumes and Margins Show Significant Year-Over-Year Growth

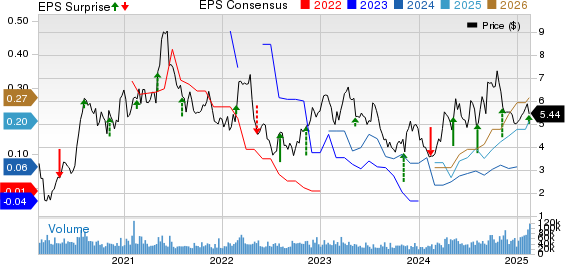

Examining Price, Consensus, and EPS Trends for Southern Copper

Southern Copper’s sales for the quarter reached $2.784 billion, surpassing the Zacks Consensus Estimate of $2.780 billion, reflecting a 21.3% increase from the previous year.

Notably, zinc sales volumes increased by 59.4% compared to a year ago. While molybdenum sales volumes dipped by 2.1%, silver volumes rose by 21.6%. Copper sales also saw a 5.4% rise.

Cost of sales rose 3.6% year over year to $1.21 billion, yet the operating profit for the fourth quarter climbed to $1.31 billion, showcasing a 50.5% increase compared to the prior year. Consequently, the operating margin expanded to 47%, up from 37.8% a year ago.

Adjusted EBITDA for Q4 grew by 42.7% to $1.51 billion, resulting in an adjusted EBITDA margin of 54.1%, compared to 46% from the previous year.

Production Insights for Southern Copper

In terms of copper production, Southern Copper mined 238,888 tons in the fourth quarter, and this represents a 2.1% increase from last year. Copper sales increased 5.4% to 229,206 tons.

For the entire year, copper production totaled 973,851 tons, an increase of 6.9%, supported by enhanced output from both Peruvian and Mexican operations. Total copper sales for the year reached 938,528 tons, a 5.5% increase year over year.

Molybdenum production for the quarter saw a slight decline, totaling 6,994 tons—a decrease of 2.6%. Sales fell by 2.1% to 7,008 tons. However, for the year, molybdenum output climbed to 28,997 tons, an 8.1% rise, while sales increased by 7.9% year over year to 29,011 tons.

The company’s zinc production skyrocketed by 154.9% year over year to 43,148 tons in Q4. Zinc sales also surged by 59.4% to 42,120 tons. In 2024, zinc production increased nearly double to 130,011 tons, while sales improved by 44.6% to 144,139 tons.

Finally, silver production saw a boost of 18.3% year over year, reaching 5.68 million ounces, and sales increased to 5.392 million ounces—up 21.6% from the previous year. For the year 2024, silver production was 20.983 million ounces, marking a 14% increase, while sales rose by 15.7% to 20.842 million ounces.

Financial Overview: Cash Flow and Balance Sheet

SCCO generated net cash from operating activities of $4.42 billion in 2024, an increase from $3.57 billion in 2023, driven by higher net income. By the end of 2024, cash and equivalents totaled $3.26 billion, a significant rise from $1.15 billion at the close of 2023. Additionally, long-term debt decreased to $5.76 billion from $6.25 billion as of December 31, 2023.

2024 Annual Performance Snapshot

For 2024, Southern Copper reported earnings per share of $4.33, reflecting a 37.9% year-over-year improvement, though it fell short of the Zacks Consensus Estimate of $4.38. The company achieved record net sales of $11.43 billion, a 15.5% increase from the previous year, despite missing consensus sales expectations of $11.57 billion.

Looking Ahead: Southern Copper’s 2025 Guidance

SCCO anticipates producing approximately 967,000 tons of copper in 2025, maintaining levels similar to those in 2024. Zinc output is projected to rise to 171,700 tons, a significant 32% year-over-year boost. Furthermore, silver production is expected to increase by 10% to 23 million ounces, while molybdenum production is anticipated to decline by 10% to 26,200 tons.

Stock Performance Recap

Over the past year, shares of Southern Copper have risen by 19.9%, outperforming the broader industry, which saw a growth of 12.4% during the same period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Highlighting Trends in Non-Ferrous Mining Stocks

Freeport-McMoRan Inc. (FCX) reported net income of $274 million, or 19 cents per share, for the fourth quarter of 2024, down 29.3% from $388 million or 27 cents per share in the year-ago quarter. Sales fell by 3.1% year over year to $5.72 billion, missing the Zacks Consensus Estimate of $5.92 billion, mainly due to reduced copper sales.

Centrus Energy Corp. (LEU) reported Q4 2024 earnings of $3.20 per share, beating the Zacks Consensus Estimate of $1.06, though down from $3.58 a year prior. Sales for the quarter were $151.6 million, exceeding the estimate of $105 million, in contrast to $104 million reported in the same quarter last year.

Southern Copper’s Current Zacks Ranking and Recommendations

Currently, Southern Copper holds a Zacks Rank #3 (Hold). A stronger pick in the basic materials sector is Carpenter Technology Corporation (CRS), which has a Zacks Rank #2 (Buy). The consensus estimate for Carpenter Technology’s 2025 earnings stands at $6.83 per share, which has increased by 1% in the last 60 days. With an average trailing four-quarter earnings surprise of 15.7%, CRS shares have surged 188% over the past year.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss out on the opportunity to invest early in our 10 top stocks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has shown remarkable and consistent success. From its inception, it has consistently delivered solid returns.

Zacks Top 10 Stocks Shine with 2,112.6% Gains Since 2012

In an impressive performance, the Zacks Top 10 Stocks have surged +2,112.6% from 2012 through November 2024. This remarkable rise outpaced the S&P 500, which only gained +475.6% during the same period. As investors look ahead to 2025, Sheraz has meticulously analyzed 4,400 companies evaluated by the Zacks Rank to select the top 10 stocks to buy and hold. You can be among the first to explore these newly released stocks with great growth potential.

Discover the New Top 10 Stocks >>

In addition to the Top 10 picks, those seeking timely investment suggestions can access Zacks Investment Research’s report featuring the “7 Best Stocks for the Next 30 Days.” Get your free download today.

Here are some individual stock analysis reports you can access:

- Freeport-McMoRan Inc. (FCX)

- Carpenter Technology Corporation (CRS)

- Southern Copper Corporation (SCCO)

- Centrus Energy Corp. (LEU)

If you would like to read the detailed article regarding Southern Copper’s earnings results, click here.

For more information, visit Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.