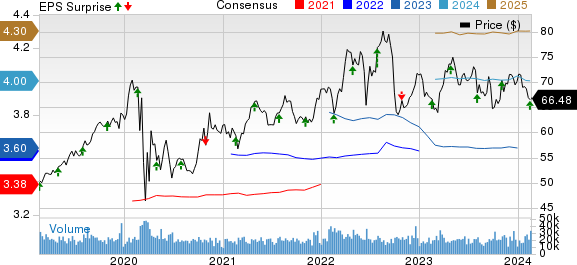

The Southern Company (SO) has stunned investors with fourth-quarter 2023 earnings per share of 64 cents, surpassing the Zacks Consensus Estimate of 59 cents. This result is a remarkable leap from the year-ago adjusted profit of 26 cents, indicating robust financial performance. Bolstered by lower operating expenses and favorable weather conditions, the power supplier demonstrated its resilience despite facing challenges due to a 14.2% drop in revenues to $6 billion, falling short of the Zacks Consensus Estimate of $7.7 billion.

Revenue Miss But Earnings Surprise

Although the top-line miss raises concerns, the company’s ability to significantly exceed earnings projections is a testament to its shrewd cost management and adaptability in fluctuating market conditions. Southern Company’s guidance of $3.95-$4.05 for this year’s earnings per share, along with its commitment to a long-term EPS growth rate projection of 5-7%, instills confidence in the company’s ability to steer through the challenging economic landscape.

Vogtle Updates

The successful commencement of Unit 3 of the Vogtle nuclear project has been a significant boost, affirming the company’s strategic initiatives. Furthermore, the forthcoming operationalization of Unit 4 in April 2024 is poised to reinforce the company’s position within the industry. The fact that Southern Company has managed to keep its share of the Georgia Power subsidiary in capital costs for the units unchanged showcases a level of fiscal prudence and diligent planning, essential for continued success in an ever-evolving market.

Sales and Wholesale Power

The decline in wholesale power sales due to a reduction in retail electricity demand and a subsequent decrease in overall electricity sales and usage has undoubtedly impacted Southern Company’s revenue. Notably, the decline of 4.3% in total electricity sales during the fourth quarter, accompanied by a 1.3% decrease in total retail sales, underscores the complex challenges faced by the company in adapting to evolving consumer behavior and market dynamics.

Financial Discipline

The power supplier’s proactive approach in reducing its operations and maintenance (O&M) costs by 13.2% year over year to $1.7 billion is commendable. Additionally, the significant 30% reduction in total operating expenses to $4.8 billion reflects exemplary financial discipline. However, while cost management remains a discernible strength, the company should remain vigilant in mitigating potential risks associated with cost reduction, ensuring that such measures do not compromise the quality of its operations and, ultimately, its service delivery to customers.

Industry Performances

As we reflect on SO’s fourth-quarter performance, it is instructive to consider how other utilities have fared. For instance, PPL Corporation (PPL) demonstrated resilience, reporting operating EPS of 40 cents, an impressive 5.3% beat from expectations. Meanwhile, American Water Works Company (AWK) experienced a 4.8% earnings beat, with an improved 2023 EPS. These varying performances across the industry highlight the dynamic nature of the utilities sector, illustrating the importance of adaptability and innovative strategies to ensure sustained growth and profitability.