Amidst the scorching heat of the stock market, semiconductor stocks stand tall, with the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) emerging as a beacon for investors seeking exposure to this dynamic sector. The historical prowess of its underlying index, an esteemed portfolio comprising stellar semiconductor stocks from various parts of the semiconductor value chain, and an invitingly low expense ratio make SOXQ a clear standout in the crowded ETF landscape.

The Strategic Dynamics of the SOXQ ETF

The DNA of SOXQ is intertwined with its foundational index, the PHLX Semiconductor Sector Index, meticulously crafted to capture the essence of the 30 largest U.S.-listed semiconductor companies. These companies delve into a gamut of semiconductor products like memory chips, microprocessors, and integrated circuits, which power a myriad of electronic devices spanning from household gadgets to automobiles and computers.

Under the unwavering Invesco (NYSE:IVZ), SOXQ gravitates towards companies engaged in the conceptualization, distribution, manufacturing, and sales of semiconductors. The index undergoes an annual rebirth every September and a quarterly recalibration to stay abreast of the sector’s oscillations.

Perusing Through SOXQ’s Treasure Trove

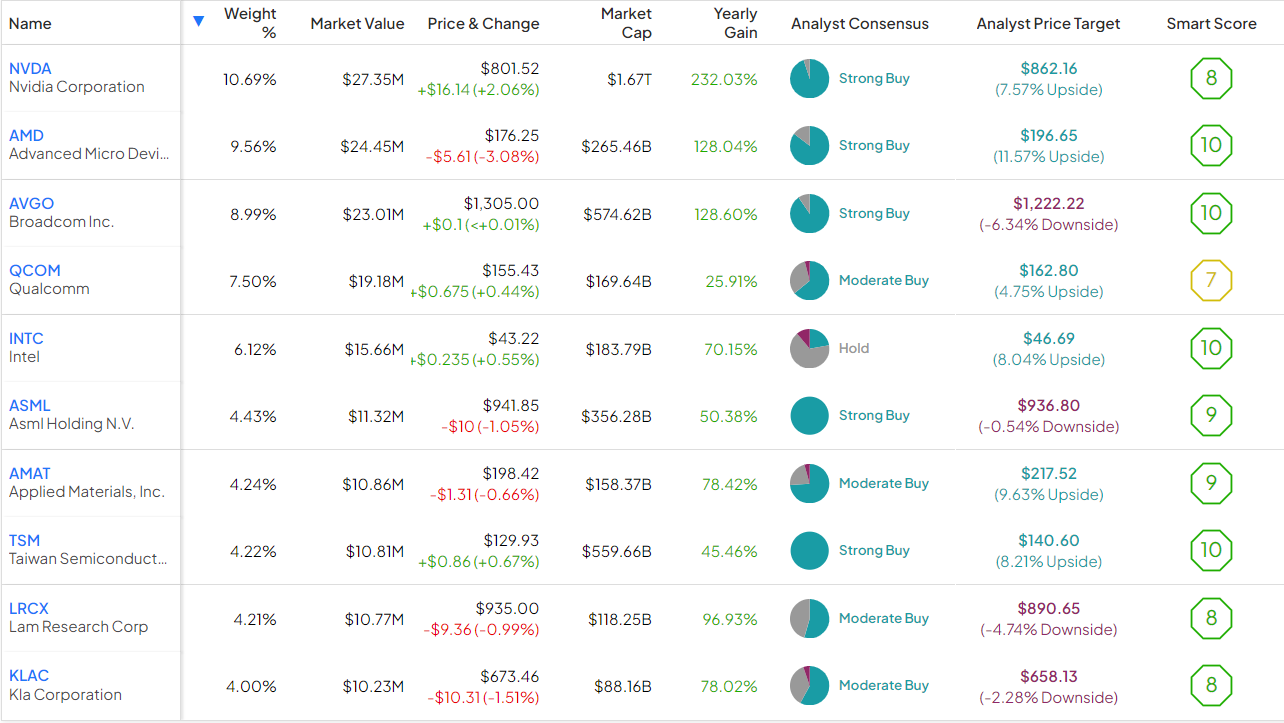

A melange of 30 semiconductor stocks form the core of SOXQ, with the top 10 holdings wielding a substantial 64.0% of the asset allocation. Delving deeper into SOXQ’s treasure chest, we witness a panoramic view of semiconductor stalwarts through the lens of TipRanks’ holdings tool.

SOXQ not only provides exposure to the trailblazers in generative AI, exemplified by Nvidia (NASDAQ:NVDA) commanding a 10.7% share in the fund, but also opens doors to contenders vying to catch up in this domain like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC).

What sets SOXQ apart is its inclusive approach across the semiconductor spectrum, encompassing not just chip developers like Nvidia but also companies spanning the semiconductor value chain. For instance, nestled within its top 10 holdings lies Taiwan Semiconductor (NYSE:TSM), the globe’s premier chip manufacturer, supplying chips to industry peers such as Nvidia, Advanced Micro Devices, and Qualcomm (NASDAQ:QCOM).

The ETF boasts positions in stalwarts like Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), and ASML Holding (NASDAQ:ASML), pivotal players offering the machinery and equipment indispensable in the semiconductor manufacturing continuum.

SOXQ’s astuteness in investing across the semiconductor spectrum stems from recognizing the integral roles these companies play in the supply chain, fortified by robust competitive advantages. Only a select few possess the technological finesse requisite for cutting-edge semiconductor production or the intricate machinery crucial for such fabrication.

These companies have all showcased robust performances over the past year. For instance, Lam Research surged by 96.9%, Applied Materials by 78.4%, ASML by 50.4%, and Taiwan Semiconductor by 45.5%.

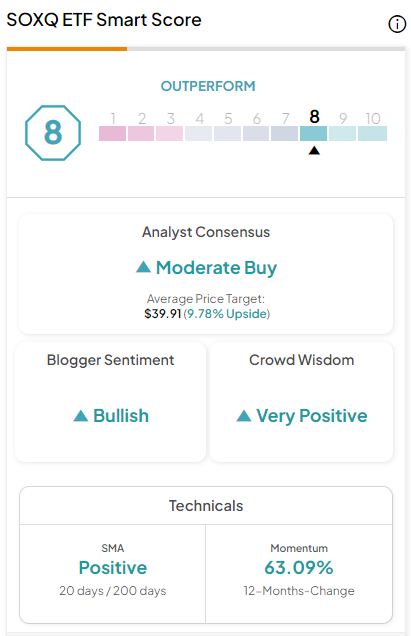

Moreover, all these equities bask in Outperform-equivalent Smart Scores according to TipRanks. The Smart Score, a proprietary quantitative stock assessment crafted by TipRanks, rates stocks on a 10-point scale grounded in eight pivotal market metrics. Scores above 8 echo an Outperform stance. Taiwan Semiconductor revels in a pristine ‘Perfect 10’ Smart Score, while Lam Research, Applied Materials, and ASML flaunt Outperform-equivalent Smart Scores of 8 or higher. Broadly speaking, a striking nine out of SOXQ’s top 10 holdings boast Outperform-equivalent Smart Scores exceeding 8.

SOXQ dons an ETF Smart Score of 8, mirroring an Outperform label.

The Legacy of SOXQ’s Index Performance

Although SOXQ embarked on its journey in 2021, offering a limited performance history, it mirrors the ebbs and flows of its bedrock index, the PHLX Semiconductor Index. 2022 witnessed a 35.6% downturn, a stark contrast to the subsequent 66.7% surge in 2023 fueled by AI advancements instigating a tech sector revival buttressed by semiconductor equities.

Fortunately, the PHLX Semiconductor Index provides a historical prism to assess SOXQ’s performance over time. As of January 31, the index showcased robust returns, registering 15.4% on a three-year annualized basis, 29.3% on a five-year annualized basis, and 25.3% on a 10-year annualized basis.

A Pocket-Friendly Expense Ratio

Boasting a meager expense ratio of 0.19%, SOXQ stands as an economical investment avenue. This translates to a mere $19 in annual fees for a $10,000 investment.

Not only is SOXQ reasonably priced in general, but its expense ratio significantly undercuts that of its counterparts. For instance, the VanEck Semiconductor ETF (NASDAQ:SMH), the iShares Semiconductor ETF (NASDAQ:SOXX), and the SPDR S&P Semiconductor ETF (NYSEARCA:XSD) all share identical 0.35% expense ratios.

SOXQ’s competitive cost structure, a product of its nascent status vying for market share against established rivals, serves as a boon for investors.

What difference does this make in the long haul? Assuming a 5% yearly return and stable expense ratios, a $10,000 investment in SOXQ incurs $243 in fees over a decade. Conversely, the same investment in any of the three larger ETFs subjects investors to $443 in fees during the same period.

SOXQ, though smaller in size, unravels as a cost-efficient gateway to semiconductor sector exposure.

Analyst Insights on SOXQ: To Buy or Not to Buy?

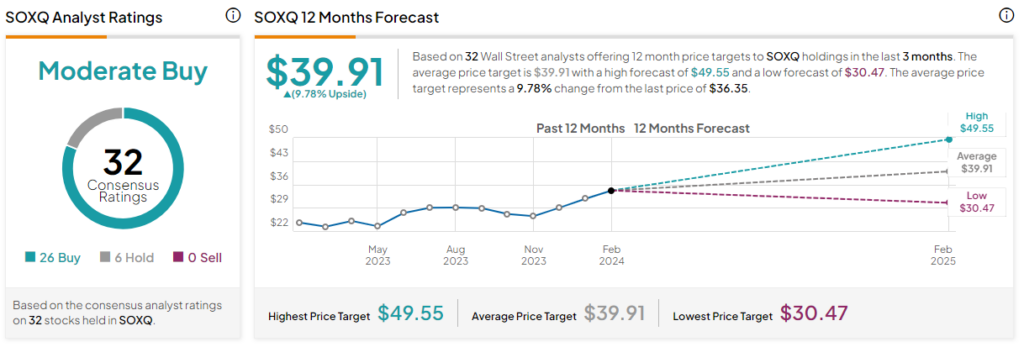

Casting a glance at Wall Street’s verdict, SOXQ garners a Moderate Buy consensus rating, with 26 Buys, six Holds, and zero Sells over the past quarter. The average price target of $39.91 implies a tantalizing upside potential of 9.8% for SOXQ.

Future Glimpses

Amidst the fervent semiconductor sector buzz, the SOXQ ETF emerges as an enticing avenue for investors. Its robust portfolio spanning the semiconductor value chain, from AI powerhouse Nvidia to chip manufacturers and equipment providers, augurs well for future growth.

Laden with the weight of expert endorsements and a rich historical performance legacy, SOXQ presents itself as a cost-effective sanctuary amidst the semiconductor frenzy, offering investors a golden ticket to ride the semiconductor wave to prosperity.

Disclaimer

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.