Understanding Recent Volatility in the Stock Market

For more than a century, the stock market has stood as the leading wealth-builder for investors. While options like real estate, Treasury bonds, and commodities—such as gold, silver, and oil—have increased in nominal value, none match the long-term annualized return of stocks. However, accessing this top-tier wealth creator comes at a cost: volatility.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Recently, both the iconic Dow Jones Industrial Average (DJINDICES: ^DJI) and the broad-based S&P 500 (SNPINDEX: ^GSPC) have encountered corrections with notable double-digit percentage declines. Meanwhile, the innovation-focused Nasdaq Composite (NASDAQINDEX: ^IXIC) officially entered bear market territory, closing on April 8.

This recent volatility has led the benchmark S&P 500 to potentially repeat a rare occurrence seen only four times since 1940. Understanding the underlying causes of this intense market fluctuation can clarify what might follow for investors.

Catalysts Behind Wall Street’s Volatility

Before exploring the rare event the S&P 500 could replicate in 2025, let’s identify three primary sources of fear and uncertainty impacting Wall Street.

The first catalyst is President Donald Trump’s “Liberation Day” tariff announcements made on April 2. He imposed a sweeping global tariff of 10% and established higher reciprocal tariff rates on several countries with historically unfavorable trade relationships with the U.S.

Even though President Trump placed a 90-day halt on higher reciprocal tariffs for all countries except China, the risk of deteriorating trade relations looms large. Such developments could negatively affect demand for U.S. goods internationally.

Additionally, confusion in differentiating between output and input tariffs arises. Output tariffs apply to finished products, while input tariffs target materials needed for U.S. production. Input tariffs can heighten inflation and render American-made goods less competitive compared to imports.

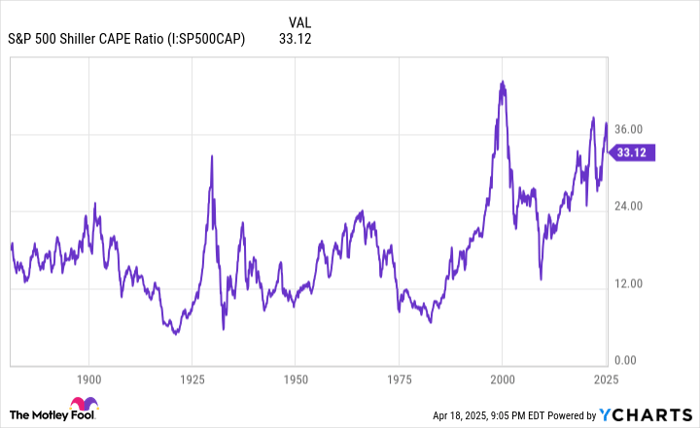

S&P 500 Shiller CAPE Ratio data by YCharts.

The second factor influencing volatility is the exorbitant pricing of stocks. As of December 2024, the S&P 500’s Shiller price-to-earnings (P/E) Ratio, also known as the cyclically adjusted P/E Ratio or the CAPE ratio, reached an unprecedented high of nearly 39. This figure significantly exceeds the historical average of 17.23 since January 1871.

Throughout over 150 years, the S&P 500 has only surpassed a Shiller P/E of 30 on six occasions, sustained for at least two months. Following these instances, at least one major stock index has typically lost 20% or more in value. This trend suggests that excessive valuations may signal a precarious position for the stock market.

The third source of market turbulence includes the sharp increase in long-term Treasury bond yields (10-year and 30-year). Such a steep rise, one of the fastest in decades, reflects inflation concerns and implies that borrowing costs for consumers and businesses may increase.

Stock chart displayed on a computer monitor.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F815332%2Fstock-chart-crash-correction-plunge-bounce-bear-market-bar-trend-invest-crypto-getty.jpg&w=700″>

Image source: Getty Images.

The S&P 500’s Historic Opportunity and Implications for Investors

Now that we have explored the reasons behind the recent market fluctuations, we can focus on the S&P 500’s potential historical moment in 2025.

Data shared by Charlie Bilello, the Chief Market Strategist at Creative Planning, highlights that the S&P 500’s 2.2% decline on April 16 marked the 18th instance this year that the index fell by at least 1% in a single session. For context, the average number of these sizeable declines in a typical year over the past 97 years (1928-2024) is 29.

Although such notable declines were common during the Great Depression and the subsequent years, they have been relatively scarce in the last 85 years. From 1940 to 2024, only four years saw large down days (1% or more) exceed 56:

- 1974: 67 large down days

- 2002: 72 large down days

- 2008: 75 large down days

- 2022: 63 large down days

Such events coincided with significant economic turmoil, including the OPEC oil embargo, the dot-com bubble burst, the Great Recession, and the bear market of 2022.

The S&P 500 fell 2.2% today, the 18th daily decline in 2025 w/ a loss of more than 1%. The average year since 1928 has 29 large declines and we’re on pace to exceed that by a wide margin. Downside volatility is the price of admission. No risk, no reward.https://t.co/yRqeegEvuv pic.twitter.com/Ln0P65mgXg

— Charlie Bilello (@charliebilello) April 16, 2025

As of April 16, the S&P 500 has experienced 18 large down days, averaging one every six calendar days—a noteworthy indicator for investors assessing their strategies amidst ongoing volatility.

Historical Trends Suggest Buying Opportunities Amid 2025’s S&P 500 Volatility

The prediction indicates that 2025 could see the S&P 500 declining by 1% or more on 62 trading days, based on the ratio of 5.89 calendar days. Such a level of downside volatility is uncommon for this benchmark index. However, historical precedents suggest a significant upside following these downturns.

Historical Patterns of Recovery

Periods of marked downside volatility have, in the past, been clear buying opportunities for investors. The S&P 500 has rewarded optimists handsomely:

- In 1974, with dividends included, the S&P 500 rose by 31.6% one year later, 38.7% after three years, and 57.4% after five years.

- Following 2002, the index surged by 28.7% one year later, 49.7% after three years, and 82.9% after five years with dividends counted.

- After the downturn in 2008 that included dividends, an increase of 26.5% was seen one year later, 48.6% three years later, and 128.2% five years later.

- Moreover, following the turbulence of 2022, the S&P 500 gained 26.3% one year later.

On average, the index showcased a total return of 28.3% in the year following such periods of pronounced downside volatility. Notably, it recorded gains 100% of the time at one-, three-, and five-year intervals where applicable.

Investing in the S&P 500: Is Now the Right Time?

As you consider investing $1,000 in the S&P 500 Index, keep the following in mind:

The Motley Fool Stock Advisor analyst team has recently pinpointed what they believe are the 10 best stocks available for investors today, and the S&P 500 Index did not make their list. The stocks that were highlighted hold the potential for substantial returns in the years ahead.

For instance, think back to when Netflix was on this list on December 17, 2004. An investment of $1,000 at that time would now be worth $524,747! Similarly, had you invested in Nvidia when it was recommended on April 15, 2005, your $1,000 investment would have grown to $622,041!

It’s worth noting that Stock Advisor boasts an average total return of 792% — significantly surpassing the 153% return for the S&P 500. Joining Stock Advisor could keep you in the loop about their latest top 10 stocks.

see the 10 stocks »

*Stock Advisor returns as of April 21, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions in this article reflect the author’s perspectives and do not necessarily represent those of Nasdaq, Inc.