Market Trends Shift as Treasuries Rise and Tech Stocks Slide

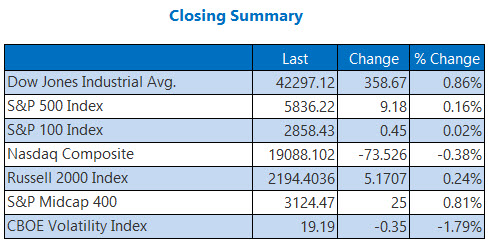

The tech sector continued to trend downward today, causing the Nasdaq to lag behind the other major indices. While it struggled, both the Dow and S&P 500 managed to recover from early losses by the end of the trading day. The Dow climbed 358 points, with major contributors like Caterpillar (CAT) and JPMorgan Chase (JPM) leading the gains. A notable rise in the 10-year Treasury yield, which reached a nearly 5% level—the highest since November 2023—has diverted attention from tech stocks, causing investors to reconsider their positions.

Here’s a closer look at today’s market highlights:

- 3 retail giants making significant movements.

- Sage Therapeutics sees an impressive surge in stock.

- In addition, a pharmaceutical stock suffers a steep decline; traders still show interest in a chip stock; and a social media company receives bearish notes from analysts.

5 Key Updates for Today

- The ongoing wildfires in Los Angeles have resulted in destruction projected to exceed $183 billion, prompting an expected rent increase of up to 12%. (MarketWatch)

- In a final push from office, President Joe Biden has forgiven student debt for 150,000 borrowers, bringing the total of his loan forgiveness efforts to $183.6 billion. (CNBC)

- Today marked the worst day ever recorded for Moderna stock.

- Call traders are unfazed by the drop in Nvidia stock.

- An analyst has downgraded a social media stock.

No notable earnings reports were released today.

Oil Prices Climb Amid Sanction Speculation

Concerns over potential new sanctions on Russian oil have driven crude prices to a five-month high in today’s trading. West Texas Intermediate (WTI) crude for February delivery increased by $2.25, or 2.9%, ending at $78.82 per barrel.

In contrast, a stronger U.S. dollar contributed to a decline in gold prices. Gold for January delivery fell 1.4%, settling at $2,677.60 an ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.