In 2025, the S&P 500 Index achieved an 18% total return, marking its third consecutive year of gains above 15%. However, performance varied significantly across sectors, with only three of the 11 sectors outpacing the broader index, influenced by trends including AI advancements and infrastructure spending.

Performance Highlights

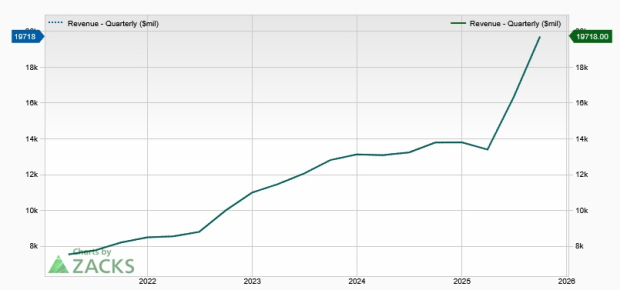

The industrial sector recorded a return of 19.5%, bolstered by strong performances from GE Aerospace (86% return) and RTX (61% return), contributing roughly 600 basis points to the sector’s total. GE Aerospace boasted a backlog of $175 billion while RTX reported $250 billion. The communications sector followed, achieving a 23% return, primarily driven by Meta Platforms (13% return) and Alphabet (66% return), together adding 1,110 basis points to the sector’s performance. Finally, the technology sector led with a 24.6% return, fueled by AI-related growth, particularly from NVIDIA (39%) and Micron Technology (240%), contributing 760 and 380 basis points, respectively.

Overall, AI’s influence extended across the industrial, communication, and technology sectors, shaping investment strategies as anticipation mounts for continued growth in 2026.