Caution Advised

The upcoming Federal Reserve meeting has the potential to trigger a significant 5-10% correction in the S&P 500 (SP500).

Despite the potential dip, the current macro environment remains positive for the stock market, with the Fed likely to reaffirm its intention to commence the interest rate normalization policy, supporting stretched valuations due to lower interest rates. Additionally, the prospect of an imminent recession is minimal, which is expected to bolster corporate earnings, thereby reducing the likelihood of a systematic credit event.

While my strategic longer-term rating on the S&P 500 remains a Buy, I have tactically downgraded the near-term rating to Hold. This adjustment signifies a cautious approach toward the broad stock market at this juncture, advocating for the realization of profits on certain speculative tactical positions.

Turbulence Ahead

Anticipate a probable 5-10% correction, potentially triggered by market reaction to the Fed’s meeting on Wednesday.

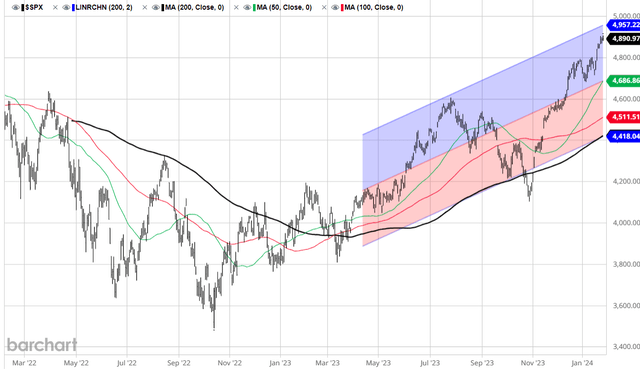

From a technical standpoint, while the price hovers below the all-time-high level following the recent range breakout, there is no natural resistance level for the S&P 500, suggesting a possible continuation of the breakout. However, the price nearing the uptrend resistance level of 4957 (generated by a regression) indicates an imminent pullback.

In the event of a correction, the price may retreat to its first support at the 50-day moving average (50dma) at 4686, representing a 4-5% dip. Should this level fail to hold, the dip could extend to the 100-day moving average (100dma) at 4511, reflecting a 7-8% correction, or to the bottom of the uptrend and the 200-day moving average (200dma) at 4418, signaling a 10% correction.

Factors Driving the Correction

Declining to signal a rate cut in March, as broadly expected, could rattle the market and provoke a correction. The market consensus expectation predicts a 50-50 chance of the Fed embarking on interest rate cuts in March based on the Federal Funds futures, yet the Fed has only hinted at three cuts in 2024, suggesting a more gradual approach.

Traders might react with disappointment if the Fed refrains from signaling a March cut or a more aggressive easing campaign for 2024, potentially leading to profit-taking and a subsequent market correction.

Macro Indications

Several indicators align with the potential for a S&P 500 correction.

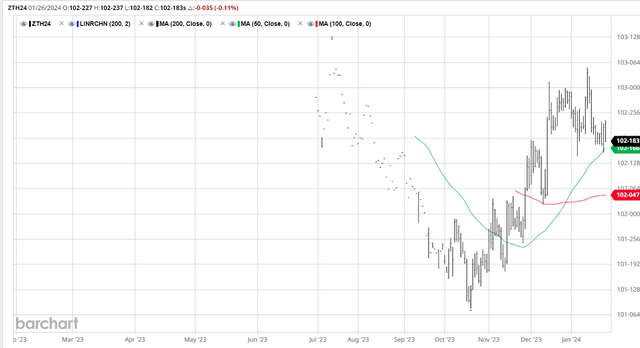

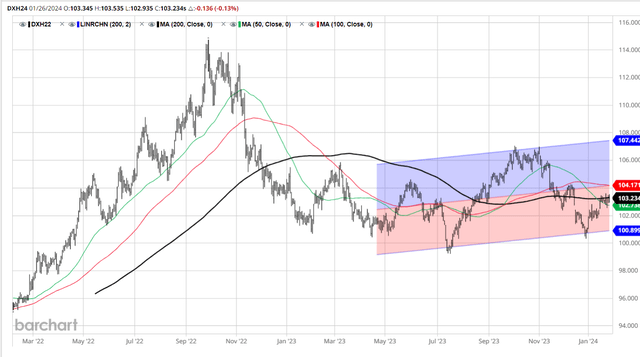

Short-term interest rates

Market consensus expectations for the Fed’s interest rate policy are reflected in the 2-Year Treasury Bills yields (US2Y). A failure to meet market expectations would likely result in increased short-term interest rates, a negative for the stock market.

Long-term interest rates

Similar to the 2-Year yields, the 10-Year Treasury Bond futures are positioned at a key support level. A disappointment from the Fed could lead to higher long-term rates, tightening financial conditions and negatively impacting the stock market.

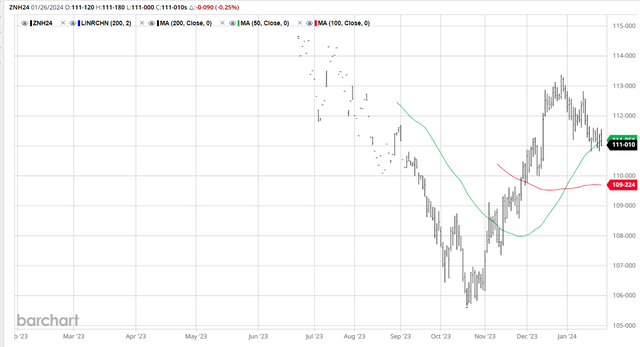

The US Dollar Index

An increase in short and long-term interest rates could cause a rise in the US Dollar Index, tightening financial conditions and acting as a catalyst for a stock market correction.

Impact and Recommendation

Fundamentally, the stock market faces a negative near-term catalyst, which could lead to the tightening of financial conditions via higher interest rates and a stronger US Dollar, detrimental for the stock market in the short term.

From a technical perspective, the S&P 500 is grappling with the uptrend range resistance. Therefore, it is advised to proceed with caution, possibly realizing profits. Importantly, the potential correction could be viewed as a buying opportunity, provided the macro environment remains conducive.