Once upon a time in the heart of every investor, there lies an unfathomable desire for undying fortune. Yet, sometimes, the unforgiving winds of financial fate blow unfavorably even for stalwart companies like SpartanNash Co. (SPTN), whose recent fourth-quarter 2023 results threw a curveball at market expectations. While the earnings per share showed improvement, the company’s net sales took a stumble, missing the Zacks Consensus Estimate. What’s the story behind SPTN’s trials and tribulations? Let’s unravel the tale.

Review of Q4 Earnings

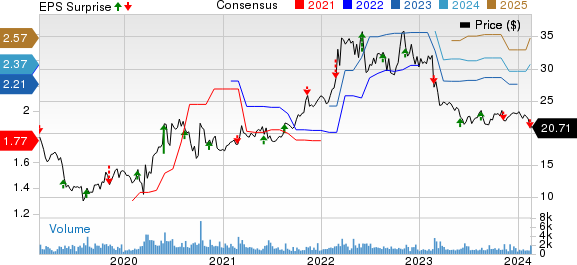

SpartanNash’s adjusted earnings revealed a mixed picture. Clocking in at 35 cents a share, there was a noticeable 25% climb from the previous year. However, these figures strayed from the esteemed Zacks Consensus Estimate of 38 cents. On the other hand, the consolidated net sales reflected a discouraging decline of 2.8% to settle at $2,245.2 million. The drop was certainly not in the script and failed to match the Zacks Consensus Estimate of $2,268 million.

Operational Analysis

The company’s gross profit suffered a marginal 0.7% decline, while a simultaneous 30 basis point expansion in the gross margin contributed a silver lining. Meanwhile, the selling, general, and administrative expenses demonstrated a sagacious 8.1% decrease and fortunately contracted by 70 basis points as a percentage of net revenues. Furthermore, the adjusted EBITDA margin expanded by 40 basis points to rest at 2.4% at the close of the quarter. Yet, even such positive operational metrics couldn’t evade the overall air of disappointment that loomed over the company’s performance.

Segment Performance

Inching further into the performance analysis, the wholesale segment saw a 2% tumble in net sales, while the retail sector sustained a larger 4.5% decline in the same metric, compounded by a 2.8% dip in comparable store sales. Causally, these shortcomings were attributed to the waning food assistance program and declining fuel sales.

Financial Outlook and Market Sentiment

Shifting gears and gazing toward the horizon, the company’s stock movement reveals a lackluster performance as it struggled to keep up with industry peers, having lost 6% in the past three months, in stark contrast to an industry-wide increase of 17%. In addition, the projections for 2024 anticipate a tepid growth pace, with a moderate dip in adjusted earnings matched with a conservative net sales expectation of $9,700-$9,900 million.

Promising Stocks in the Same Space

While SpartanNash is warily navigating the tempest, some better-ranked competitors such as Casey’s General Stores, Inc. (CASY), Sprouts Farmers Market, Inc. (SFM), and Target Corporation (TGT) have been making strides in a similar arena.

Casey’s, with a Zacks Rank of 2 (Buy), has been showing promising growth, exemplified by the Zacks Consensus Estimate that suggests a positive trajectory for its earnings and sales.

Sprouts Farmers Market, holding a Zacks Rank #2 presents a compelling narrative of financial success. Likewise, Target Corporation’s Zacks Consensus Estimate reflects a favorable current fiscal-year earnings outlook.

Dare we say, in the company of these shining stars, SpartanNash seems to have dimmed its luster in the eyes of investors?

In Conclusion

With the arrival of transformative initiatives and strategic acquisitions, SpartanNash has set its sails toward steering the ship of growth. Despite the recent headwinds, will the company be able to rewrite its narrative and reclaim its lost glory?

Only time will tell whether SpartanNash can stage a comeback worthy of a gripping Dickensian tale or whether it’s destined to fade into the annals of financial history. Investors everywhere are no doubt on the edge of their seats, awaiting the next chapter in this compelling saga.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.