SPDR Bloomberg Emerging Markets Local Bond ETF Sees Oversold Conditions

Investors Eye Potential Buying Opportunities as Share Price Dips

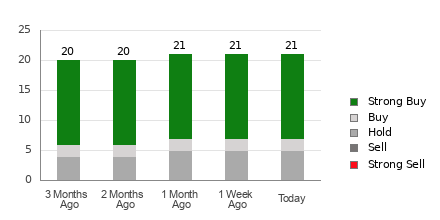

On Friday, trades for the SPDR Bloomberg Emerging Markets Local Bond ETF (Symbol: EBND) showed signs of oversold conditions, with shares dropping to as low as $20.13 each. The term “oversold” refers to a situation defined by the Relative Strength Index (RSI), a tool that measures market momentum on a scale of 0 to 100. If the RSI falls below 30, a stock is typically deemed oversold.

For SPDR Bloomberg Emerging Markets Local Bond, its RSI reading currently sits at 29.8. In comparison, the S&P 500 has an RSI of 50.4. Investors with a bullish outlook may interpret EBND’s reading of 29.8 as a potential signal that recent heavy selling might be nearing its end, prompting them to seek buying opportunities.

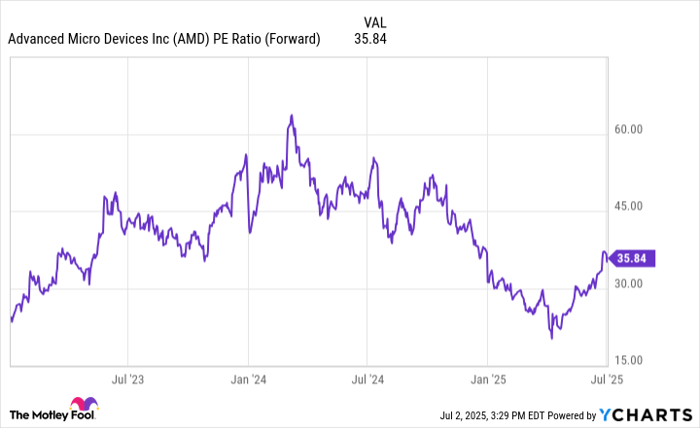

Examining its performance over the past year, EBND has a 52-week low of $19.73 per share and a 52-week high of $21.425, with the latest price trading at $20.11. Today, shares of SPDR Bloomberg Emerging Markets Local Bond are down approximately 0.8%.

![]() Click here to find out what 9 other oversold dividend stocks you need to know about »

Click here to find out what 9 other oversold dividend stocks you need to know about »

See Also:

- Cheap Small Cap Stocks

- FG Market Cap History

- Funds Holding NPF

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.