Spectrum Brands Holdings Inc. SPB is benefiting from increased pricing, cost improvements and a favorable mix. The company is progressing well with its Global Productivity Improvement Plan, which aims at improving operating efficiency and effectiveness.

In the latest developments, the company unveiled that its fully-owned subsidiary, Spectrum Brands, Inc., offered $300 million in total principal amount of its 3.375% exchangeable senior notes due 2029 in a private placement to eligible purchasers under Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”).

Let’s Delve Deep

The company plans to utilize the net proceeds from the offering to fund the $21.6 million cost of entering into the capped call transactions, general corporate purposes and to repurchase about $50 million of shares of common stock of Parent concurrent with the pricing of the offering of the Exchangeable Notes in privately negotiated transactions. Such transactions are effected through one of the initial purchasers or its affiliates.

Concerning the offering, if the initial purchasers sell more Exchangeable Notes than the overall principal amount of the Exchangeable Notes, they have the option to purchase, for settlement within a 13-day period starting and including the date the Exchangeable Notes are first issued, up to an additional $50 million total principal amount of Exchangeable Notes.

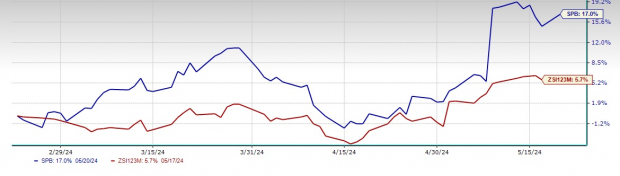

Image Source: Zacks Investment Research

Further, the sale of the Exchangeable Notes is anticipated to close on or about May 23, 2024, and is subject to the customary closing conditions. This is likely to result in $291.6 million in net proceeds to the company, after the deduction of the initial purchasers’ discount, assuming no exercise of the initial purchasers’ option, but before the deduction of planned offering expenses payable by the company and the cost of the capped call transactions.

In connection with the pricing of the Exchangeable Notes, Spectrum Brands is likely to make share repurchases at a cash purchase price per share, which is equal to the closing price per share of the Parent Common Stock on May 20, 2024. The company anticipates that one of the initial purchasers and/or its affiliate will buy the shares from purchasers of Exchangeable Notes in the offering and will sell the shares to the Parent at closing.

Such repurchases can increase or decrease the extent of any decline in the market price of the Parent Common Stock or the Exchangeable Notes. Also, repurchases might affect the market price of the Parent Common Stock concurrently with the pricing of the Exchangeable Notes, and result in a higher effective exchange price for the Exchangeable Notes.

The company has announced that its wholly-owned subsidiary, Spectrum Brands, has commenced a cash tender of up to a total principal amount of its outstanding 4% Senior Notes due 2026, 5% Senior Notes due 2029, 5.50% Senior Notes due 2030 and 3.875% Senior Notes due 2031.

Shares of this Zacks Rank #2 (Buy) company have gained 17% in the past three months compared with the industry‘s 5.7% rise.

Other Key Picks

Some other top-ranked companies are Ralph Lauren RL, Royal Caribbean RCL and lululemon athletica LULU.

Ralph Lauren sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ralph Lauren has a trailing four-quarter earnings surprise of 18.7%, on average. The Zacks Consensus Estimate for RL’s fiscal 2024 earnings per share (EPS) indicates an increase of 22.7% from the year-ago period’s reported level.

Royal Caribbean currently flaunts a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 28.3%, on average.

The consensus estimate for RCL’s 2023 sales and EPS indicates increases of 14.5% and 47.9%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 13.7% and 15%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Spectrum Brands Holdings Inc. (SPB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.