Spirit AeroSystems Shares Surpass Analyst Target Price of $36.50

In recent trading, Spirit AeroSystems Holdings Inc (Symbol: SPR) shares have surpassed the average analyst 12-month target price of $36.50, currently trading at $36.70 per share. When a stock reaches its target price, analysts typically have two options: downgrade the stock on valuation or adjust their target price higher. Additionally, analyst reactions may vary based on the company’s fundamentals that are influencing the stock price’s upward movement. If conditions seem favorable, it may warrant an increase in the target price.

Analyst Target Prices Overview

Within the Zacks coverage universe, there are 10 analysts contributing to the average price target for Spirit AeroSystems. While the average is a useful measure, it hides the variation among individual targets. One analyst has set a target as low as $33.00, while another has a more optimistic outlook, projecting a price of $37.25. The standard deviation among these targets is $1.404.

The purpose of analyzing the average target price is to leverage collective insights from multiple analysts, rather than relying on any single expert opinion. With SPR surpassing the average target of $36.50 per share, it provides investors with a crucial opportunity to evaluate the company’s prospects. They must decide whether the price of $36.50 marks only a temporary milestone or if it indicates a potential overvaluation, prompting them to consider reducing their holdings.

Current Analyst Ratings for Spirit AeroSystems

| Recent SPR Analyst Ratings Breakdown | ||||

|---|---|---|---|---|

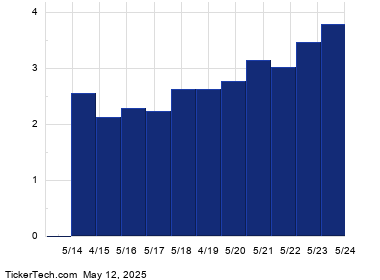

| » | Current | 1 Month Ago | 2 Months Ago | 3 Months Ago |

| Strong buy ratings: | 1 | 1 | 1 | 1 |

| Buy ratings: | 0 | 0 | 0 | 0 |

| Hold ratings: | 11 | 11 | 13 | 14 |

| Sell ratings: | 0 | 0 | 0 | 0 |

| Strong sell ratings: | 0 | 0 | 0 | 0 |

| Average rating: | 2.83 | 2.83 | 2.86 | 2.87 |

The average rating reflects a scale from 1 to 5, where 1 indicates a Strong Buy and 5 indicates a Strong Sell. Data used in this analysis is sourced from Zacks Investment Research through Quandl.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of any affiliated organizations.