Analysts See Potential Growth for SPMD ETF and Key Holdings

At ETF Channel, we have analyzed the underlying holdings of various ETFs and compared their trading prices with the average analyst 12-month target prices. The results show an intriguing potential for the SPDR Portfolio S&P 400 Mid Cap ETF (Symbol: SPMD), where the implied target price based on its holdings is $62.22 per unit.

Current Valuation and Growth Prospects

Recently, SPMD has been trading around $56.41 per unit, suggesting analysts expect a 10.30% upside as the target prices for its underlying holdings come into play. Notably, three of these holdings show significant upside potential: Fabrinet (Symbol: FN), ASGN Inc (Symbol: ASGN), and STAG Industrial Inc (Symbol: STAG). Fabrinet’s recent price is $232.26 per share, while analysts project a target of $265.17 per share—a 14.17% increase. ASGN, trading recent at $85.74, has an average target price of $97.50, indicating a potential upside of 13.72%. For STAG, the target price is forecasted at $41.00, which is 12.85% above its current trading price of $36.33.

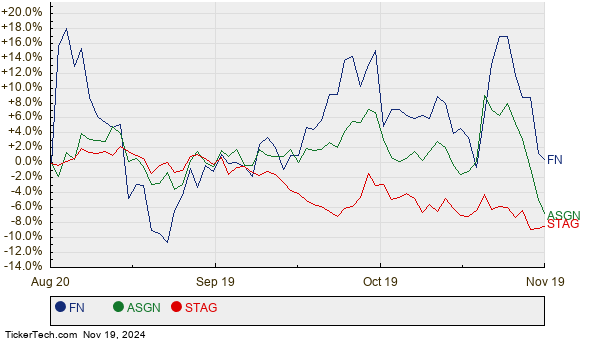

Performance Overview

Here’s a chart showing the 12-month price performance of FN, ASGN, and STAG:

Analyst Target Summary

Below is a summary of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 400 Mid Cap ETF | SPMD | $56.41 | $62.22 | 10.30% |

| Fabrinet | FN | $232.26 | $265.17 | 14.17% |

| ASGN Inc | ASGN | $85.74 | $97.50 | 13.72% |

| STAG Industrial Inc | STAG | $36.33 | $41.00 | 12.85% |

Questions for Investors

Investors might wonder if these price targets are realistic or overly optimistic. Are analysts properly accounting for recent changes in the companies and their sectors? A higher target price versus a trading price can indicate optimism, but it might also suggest past expectations. These considerations warrant further research from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

CLOV Options Chain

Funds Holding BLHY

Institutional Holders of APVO

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.