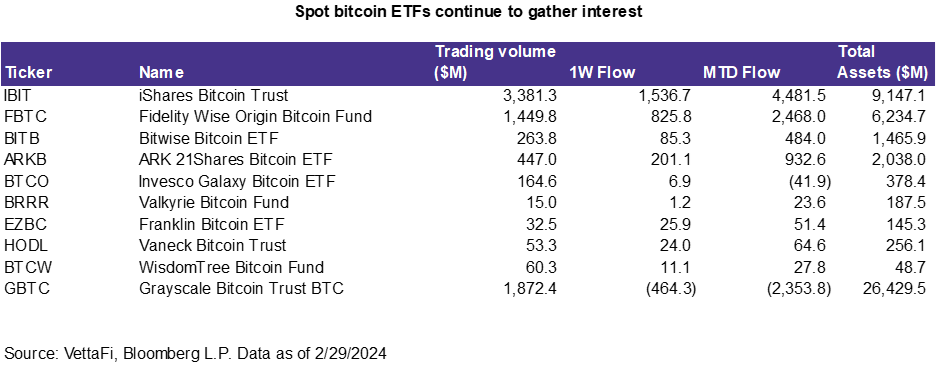

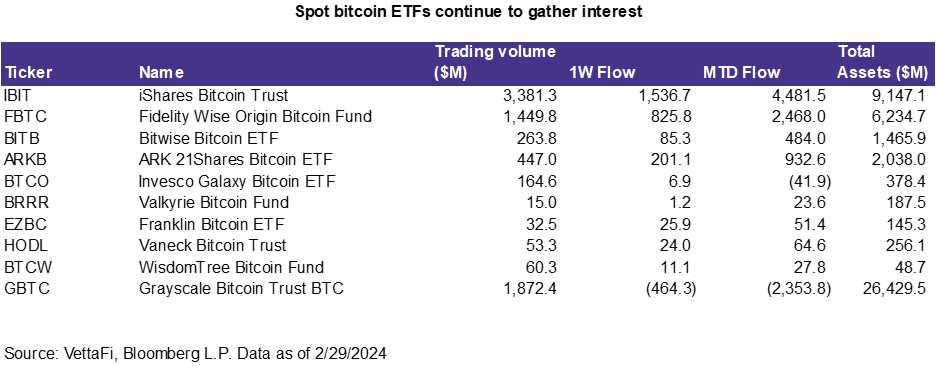

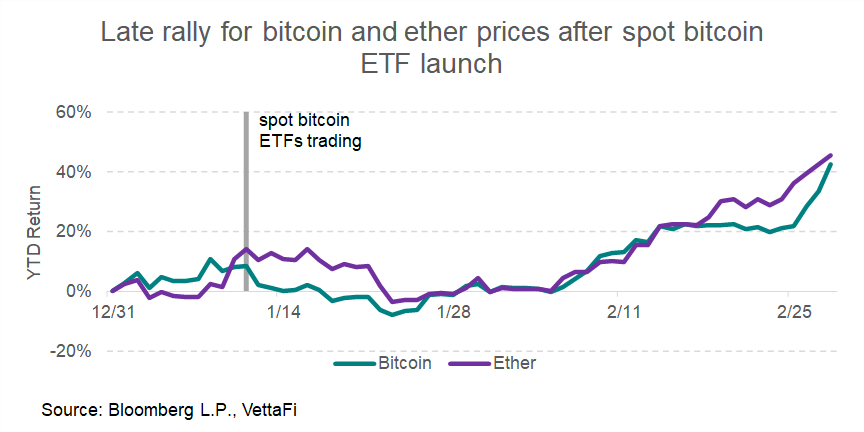

This week, bitcoin prices soared past $60,000, reaching levels unseen since November 2021. The unveiling of spot bitcoin ETFs in early January has sparked significant interest, with these new offerings (excluding GBTC) attracting over $7 billion in net inflows.

Amidst this fervor, ether prices have quietly surged to $3,300, marking their highest point since April 2022. Nevertheless, spot ether ETFs have garnered relatively less attention, possibly due to ether’s smaller share in the crypto market compared to bitcoin. Despite this, there are compelling reasons behind the emergence of spot ether ETFs, as seen in other niche ETF segments which carve out their own place in the market.

Unpacking the Need for Spot Ether ETFs Among Retail Investors

Although both ether and bitcoin fall under the cryptocurrency category, their utility diverges significantly. Bitcoin was conceived as a fiat currency alternative, characterized by decentralization to disentangle it from corporate or governmental control. In contrast, Ethereum leverages smart contracts to power dApps (decentralized applications). While these digital assets are interrelated, their distinct use cases and investment rationales may attract different investor profiles, with dedicated crypto investors often diverging from traditional retail players.

With spot bitcoin ETFs, a subset of retail investors eyeing bitcoin but hesitant to dive in directly found solace in these instruments. ETFs provided a conduit for seamless bitcoin exposure in brokerage accounts through reputable entities like BlackRock and Fidelity. For these investors, bitcoin’s appeal stems from diversification benefits, its role as an inflation hedge, the allure of digital disruption, and the promise of compelling returns.

While both bitcoin and ether boast these attributes, the retail segment may not necessarily see the need to invest in both assets. Institutional demand persists, but lacking a resounding case for retail investors, spot ether ETFs have operated in bitcoin’s shadow, with products like iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) commanding more attention.

The Probable Approval Path for Spot Ether ETFs, with Likely Conditions

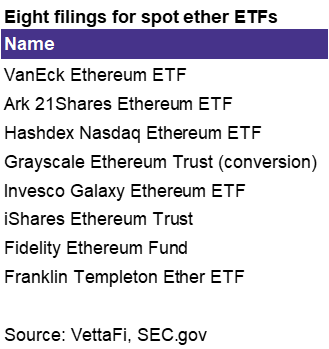

Despite the lesser limelight surrounding spot ether ETFs vis-a-vis their bitcoin counterparts, these products are gradually gaining traction within both the crypto and ETF spheres. Currently, eight issuers have submitted filings for spot ether ETFs. Notably, given ether’s complexity and relatively niche status compared to bitcoin, I anticipate that issuers who ventured into spot bitcoin ETFs might be more inclined to explore the ether space. Notable holdouts in the realm of spot ether ETF filings include Bitwise, Valkyrie, and WisdomTree, who are yet to step in.

The VanEck Ethereum ETF faces a final decision deadline by May 23, followed by the Ark 21Shares Ethereum ETF on May 24. The SEC is poised to make a call by then, likely greenlighting multiple products, akin to its stance on ether futures ETFs and spot bitcoin ETFs. While approval seems probable (given the precedent set by bitcoin futures ETFs for spot bitcoin ETFs), I envision a series of deliberations to align these offerings, potentially focusing on cash redemptions and imposing certain guardrails around staking.

The Controversy Surrounding Staking Mechanisms in Ether ETFs and their Standoff with the SEC

Recently, the Ethereum network pivoted to a proof-of-stake model, where validators stake ether to earn rewards. Currently, Coinbase offers a 2.7% APY for staking ether. Out of the eight spot ether ETF filings, only Ark 21Shares and Franklin Templeton have incorporated staking provisions. Staking may not necessarily enhance ether’s appeal to new investors, especially considering the higher yields obtainable through safer alternatives like dividend ETFs, money market funds, or high-yield savings accounts.

The inclusion of staking mechanisms adds another layer of complexity to an already contentious launch with the SEC. Staking resembles features synonymous with traditional securities, such as earning interest or dividends, prompting prior legal tussles between the SEC and exchanges like Kraken and Coinbase. Pertinently, while staking products exist in other countries’ exchange-traded offerings, the U.S. SEC’s approach remains uncertain. Canada, ahead in the spot bitcoin ETF race, has approved ether ETFs that encompass staking, exemplified by 3iQ’s Ether Staking ETF (TSX: ETHQ) and the Ether Fund (TSX: QETH).

For more news, information, and strategy, visit the Crypto Channel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.