Spotify Stock Surges 18%: Can It Maintain the Momentum?

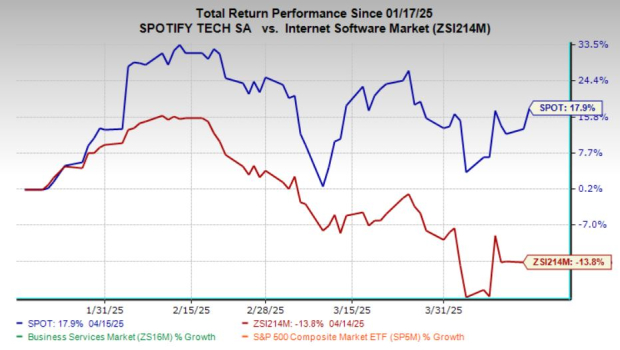

Spotify Technology S.A. (SPOT) shares have increased by 18% over the past three months, contrasting with a 14% decline in its industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In contrast, Spotify’s competitors in music streaming have experienced losses in the same period. Apple (AAPL) declined by 12%, Amazon (AMZN) fell 21%, and Alphabet (GOOGL) dropped 20%. Despite these setbacks, these giants maintain strong positions in other sectors, prompting questions regarding Spotify’s ability to sustain its recent success amidst fierce competition.

Given the recent rise in SPOT’s shares, investors may consider capitalizing on this upward trend. However, a vital question remains: Is now the right time to invest in Spotify, particularly when compared with the performance of titans like Amazon, Apple, and Alphabet? Let’s analyze the situation.

Key Growth Drivers: Content Quality and Price Increases

A robust content library greatly enhances Spotify’s monthly active users (MAU), which in turn drives revenue growth. The annual Wrapped campaign also significantly contributes to MAU and subscriber growth. For the fourth quarter of 2024, MAUs rose by 35 million, totaling 675 million, surpassing management’s guidance by 10 million. Additionally, premium revenue saw a year-over-year growth of 19%, attributed to effective pricing strategies for new users, indicating that many of the new active users are high-quality paying subscribers with strong average revenue potential as premium features are monetized.

Moreover, Spotify’s performance benefits from consistent price increases, a dedicated user base, and considerable cost reductions. Notably, the company has successfully raised prices without diminishing new subscriber acquisition. As other streaming services also increase prices, Spotify’s hikes remain in line with industry trends.

Strong Capital Returns for Spotify

Spotify displays effective capital efficiency with a trailing 12-month return on invested capital (ROIC) of 23.55%, exceeding the industry average of 21.84%. This suggests that the company allocates its resources effectively to foster profitable growth. A higher ROIC indicates that Spotify is managing its investments more efficiently than many competitors, reinforcing its industry position. Persistently high ROIC figures point to sound financial stewardship and the potential for ongoing long-term profitability.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Positive Top and Bottom-Line Forecasts for Spotify

Looking ahead, Spotify’s growth prospects are promising, with the Zacks Consensus Estimate projecting revenues of $18.9 billion in 2025 and $21.7 billion in 2026. These figures reflect year-over-year growth rates of 11.7% and 14.8%, respectively. Earnings per share (EPS) estimates are $10.4 for 2025 and $13.3 for 2026, marking significant increases of 74.3% and 27.8% year-over-year.

Image Source: Zacks Investment Research

Such projections highlight Spotify’s ability to broaden its revenue base while enhancing profitability. Strong growth in both revenue and earnings underscores the company’s capacity for scaling its operations within the competitive music streaming space.

Liquidity Position at Spotify Underperforms the Industry

In the fourth quarter of 2024, Spotify’s current ratio stood at 1.88, which lags behind the industry average of 2.54. Nevertheless, this metric has improved by 10% from the previous quarter. A current ratio above 1 indicates sound short-term debt coverage ability, suggesting some financial stability.

Valuation Concerns for Spotify

The recent increase in SPOT’s stock price has pushed valuations higher. Currently, the stock trades at 52.2 times its forward 12-month earnings per share, significantly above the industry average of 31.3 times. While optimism about growth prospects supports this premium, sustaining such high multiples may prove to be difficult. A shortfall in growth expectations could lead to a correction in valuation.

Recommendations: Wait for an Optimal Entry Point

SPOT’s stock rise can be attributed to strong revenue growth and improved pricing power. A commitment to maintaining high content quality and an increase in MAUs sets the groundwork for long-term success. A solid liquidity position, coupled with an encouraging outlook for revenue and earnings, adds to the company’s advantages.

That said, Spotify faces notable challenges, including heightened competition, reliance on third-party licenses, and an inflated valuation. With a current forward price-to-earnings ratio of 54.8X, above industry norms, short-term growth might be constrained.

Investors are advised to adopt a “Hold” strategy, awaiting clear indicators of sustainable growth and a potential decline in valuation before adjusting their investment positions.

Presently, Spotify is rated at Zacks Rank #3 (Hold). You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names Top Semiconductor Stock

Our new top chip stock is currently just 1/9,000th the size of NVIDIA, which has surged more than +800% since our recommendation. NVIDIA remains strong, but this new stock has considerable growth potential.

With tremendous earnings growth and an expanding customer base, this semiconductor stock is set to meet the skyrocketing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.