Spotify Technology S.A. reported a 15% year-over-year revenue increase for Q1 2025, attributed to subscriber growth and higher average revenues per user, along with stronger ad sales. This growth led to a gross margin expansion of 400 basis points, reaching 31.6%, with significant contributions from both Premium and Ad-Supported segments.

The company successfully reduced operating expenses by 3% year-over-year, which, together with revenue growth, resulted in a record-high operating income that soared 203%, boosting the operating margin by 750 basis points. Spotify’s return on equity (ROE) stood at 22.5%, trailing behind Apple’s 167.2% and Amazon’s 24.1%, while its return on invested capital (ROIC) of 24% exceeded Amazon but lagged Apple.

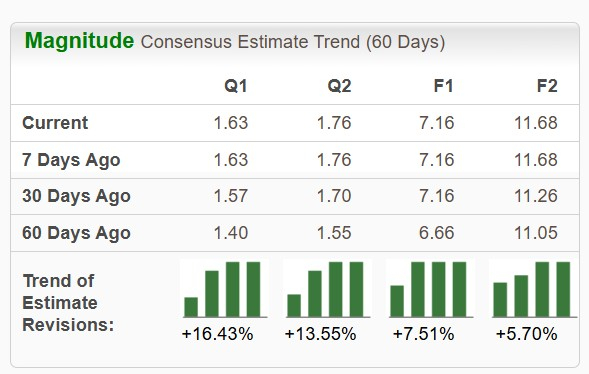

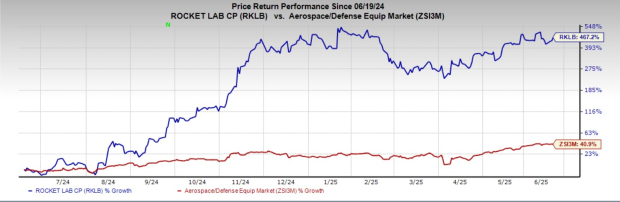

Spotify’s stock has surged 129.2% over the past year, outperforming the industry’s 37.6% rise. The Zacks Consensus Estimate for Spotify’s earnings in 2025 is $9.26 per share, indicating a year-over-year growth of 55.6%.