Sprouts Farmers Market, Inc., popularly known for its fresh and healthy offerings, unveiled its fourth-quarter 2023 performance, surpassing both revenue and profit projections. The company’s exceptional results were fueled by robust comparable sales, increased foot traffic, rapid unit expansion, and enhanced customer engagement, painting a picture of success in the competitive market landscape.

Q4 Performance Highlights

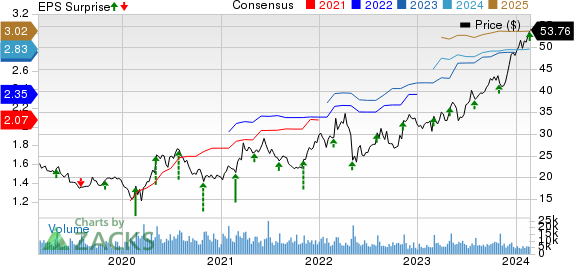

In terms of financials, Sprouts Farmers delivered adjusted earnings of 49 cents per share, surpassing the Zacks Consensus Estimate of 45 cents. Noteworthy is the fact that the bottom line exhibited an astonishing 16.7% surge compared to the previous year, marking a substantial achievement.

Moreover, the company reported net sales of $1,698.5 million, surpassing the Zacks Consensus Estimate of $1,690 million. This impressive growth of 7.7% year-over-year was primarily attributed to revenues from new stores and a significant uptick in comparable store sales.

Of particular interest is the 3.3% rise in comparable store sales during the quarter, exceeding initial estimates of a 3% uptick. The company also witnessed a substantial 17% growth in e-commerce sales, signaling a move in the right direction in catering to changing consumer preferences.

Margin Expansion and Operational Updates

Sprouts Farmers achieved an 8.3% increase in adjusted gross profit, amounting to $620.4 million for the quarter. The company also managed to expand its adjusted gross margin by 20 basis points to 36.5% compared to the same period last year.

Operating income saw an uplift as well, with an adjusted figure of $69.4 million for the quarter, a significant jump from $61.9 million reported in the prior-year period. This translated to an improved operating margin by 20 basis points, reaching 4.1%, highlighting the company’s operational efficiency.

Despite a modest increase of 8.6% in SG&A expenses amounting to $513.5 million, Sprouts Farmers effectively managed its costs. The company is strategically expanding its store network, with six new stores opened during the quarter, bringing the total count to 407 stores across 23 states by the end of 2023.

Financial Outlook and Strategic Initiatives

Looking ahead, Sprouts Farmers anticipates a positive trajectory in the first quarter of 2024, with expected comparable store sales growth falling between 2.5% and 3.5%. Adjusted earnings are forecasted to range between 98 cents and $1.02 per share, reflecting a slight increase from the previous year.

Moreover, the company is gearing up for a growth spurt in 2024, with plans to open 35 new stores, aiming to enhance customer accessibility and bolster its market presence. Additionally, the strategic investment of approximately $15 million towards a loyalty program demonstrates Sprouts Farmers’ commitment to customer satisfaction and loyalty.

Despite facing some challenges such as increased wage costs and ongoing strategic investments leading to SG&A pressure, Sprouts Farmers remains optimistic, projecting an increase in gross margin while expecting adjusted earnings to range between $2.85 and $2.95 per share for the full year.

This Zacks Rank #2 (Buy) stock has outperformed the industry with a remarkable 38% surge in the past six months, showcasing unwavering investor confidence and highlighting its potential for sustained growth in the future.